You’re being robbed by your bank’s overdraft protection racket.

Corruption, World news Thursday, July 19th, 2012

Are you a victim of the banks’ overdraft protection racket? Have you ended up paying $40 for a cup of coffee because your bank’s overdraft protection racket allowed the transactions to go through even though you didn’t have sufficient funds in your account? Did you know that in 2009 banks were ordered to secure their customers’ consent before charging overdraft fees on ATM and debit card transactions?

Effective July 1, 2010 all US banks are required to notify new and existing customers of their overdraft services and give customers the option of being covered. If customers don’t “opt in,” any debit or ATM transactions that overdraw their accounts must be denied. Canadian banks are also required to notify new and existing customers and obtain written consent before this protection racket scheme can be applied to your accounts. So look at your bank statements for any entry for overdraft protection fees. If you did not authorize the overdraft the overdraft can not be added to your banking services and if done without your knowledge or written consent the bank didn’t just make a mistake they intentionally committed fraud. It is a protection racket. An extortion scheme whereby the banks defraud (illegally obtain money by intentional deception) their customers into paying for protection services against overdraft.

The 2010 financial regulation prohibits financial institutions from discriminating against consumers who do not opt in. The financial regulation require institutions to provide consumers who do not opt in with the same account terms, conditions, and features (including pricing) that they provide to consumers who do opt in. For consumers who do not opt in, the institution would be prohibited from charging overdraft fees for any overdrafts it pays on ATM and one-time debit card transactions.

Even if you opt in you can force the bank to reverse the charges. Overdraft protection is, for all intents and purposes, illegal – the banks are loansharking – a criminal offence. The fee banks charge to loan you the money to buy very small purchases like a cup of coffee exceeds the legal limit banks or anyone can charge you. If you paid $40 for a $2 cup of coffee because of the overdraft protection racket the bank has just illegally loaned you the money at a whooping, but none the less, illegal 2000%. Loansharking is the practice of lending money at usurious, and illegal interest rates.

18 USC § 892 – Making extortionate extensions of credit

(a) Whoever makes any extortionate extension of credit, or conspires to do so, shall be fined under this title or imprisoned not more than 20 years, or both.

(2) The extension of credit was made at a rate of interest in excess of an annual rate of 45 per centum calculated according to the actuarial method of allocating payments made on a debt between principal and interest, pursuant to which a payment is applied first to the accumulated interest and the balance is applied to the unpaid principal.

(3) At the time the extension of credit was made, the debtor reasonably believed that either

(A) one or more extensions of credit by the creditor had been collected or attempted to be collected by extortionate means, or the nonrepayment thereof had been punished by extortionate means; or

(B) the creditor had a reputation for the use of extortionate means to collect extensions of credit or to punish the nonrepayment thereof.

(4) Upon the making of the extension of credit, the total of the extensions of credit by the creditor to the debtor then outstanding, including any unpaid interest or similar charges, exceeded $100.

Sections 891 to 896 of Title 18, United States Code, are designed principally to bring the resources of Federal law enforcement to bear on the loansharking activity of criminal organizations like your bank.

Section 891 is the definitional section.

Section 893 prohibits the willful advancement of money or property to any person “with reasonable grounds to believe that it is the intention of that person to use the money or property so advanced directly or indirectly for the purpose of making extortionate extensions of credit.”

Section 894 prohibits “use of an extortionate means . . . to collect or attempt to collect any extension of credit, or to punish any person for the nonrepayment thereof.”

Section 896 makes it clear that state prosecutions for extortionate credit transactions are not preempted by the Federal statute.

Any loan that charges above the usury laws of a state is illegal.

In all credit sales, the federal Consumer Credit Protection Act, also known as the Truth in Lending Act (15 U.S.C.A. § 1601 et seq. [1968]), applies.

In Canada, loan-sharking is officially designated as a criminal offence if the effective rate (including fees and penalty payments) exceeds 60% per annum.

So any time your bank charges you a overdraft protection fee on a loan that is more than the purchase price, lay criminal charges against the bank. The federal Consumer Credit Protection Act, also known as the Truth in Lending Act protects you, the consumer, not bank policy. Any and all bank policies that violates the law are illegal – criminal offences.

What crimes are intentionally committed by the banks against you through their overdraft protection racket? Three of the most serious offenses include fraud, loansharking and forgery. If you didn’t authorize the overdraft protection they illegal fabricated your consent. They created a forgery “the creation of a false written document or alteration of a genuine one, with the intent to defraud”. It is an attempted rewriting of the contract by your bank, without your written consent. This is called a contract novation. The banks must have your written consent to alter or rewrite any financial instrument. That includes raising loan and credit interest rates and service fess for all your accounts. If they alter any part of the original contract (i.e. a single letter or digit, dollar value, interest rate) between them and you without your knowledge or written consent they are knowingly and willingly defrauding you.

In the meantime, your best protection against illegal bank charges and fees is to opt out of overdraft protection and remove it from all of your accounts. If you didn’t authorize the overdraft protection your bank must reimburse you for all overdraft charges, fees and interest applied to your account(s). If they don’t tell them you’re going to go to your local police and file formal criminal charges against your bank’s manager. Don’t attempt to charge the bank unless you want a long drawn out and expensive legal battle. Your bank’s manger is legally responsible for all employees at his or her bank and all transacts. Bank policies are implemented by the bank manger. No loan or credit can be offered to any bank customer without his or her knowledge or authorization. He or she can be successfully indicted for committing a criminal offense.

Be smart. Don’t become a victim of the bank’s overdraft protection racket. So what if the store clerk tells you that your purchase is denied for insufficient funds. It’s a lot cheaper than paying more than what their product is worth. Besides, if you ever return your purchase the banks don’t return the overdraft protection racket fee.

Short URL: https://presscore.ca/news/?p=6794

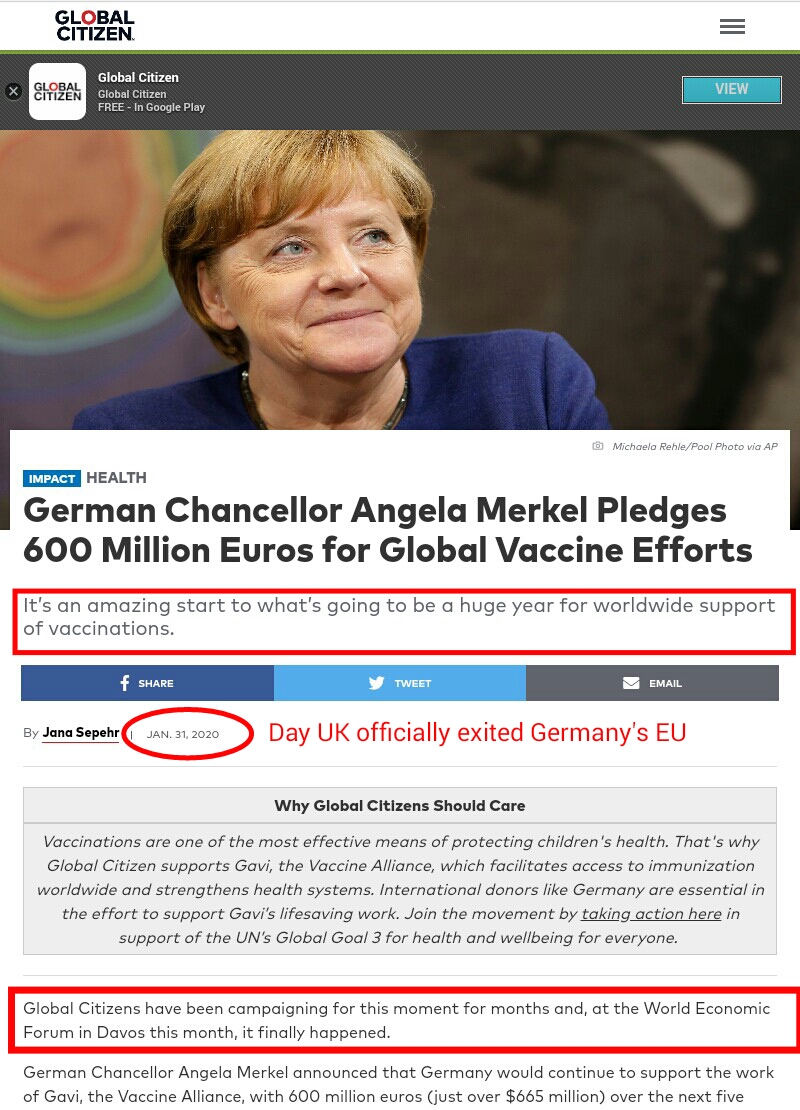

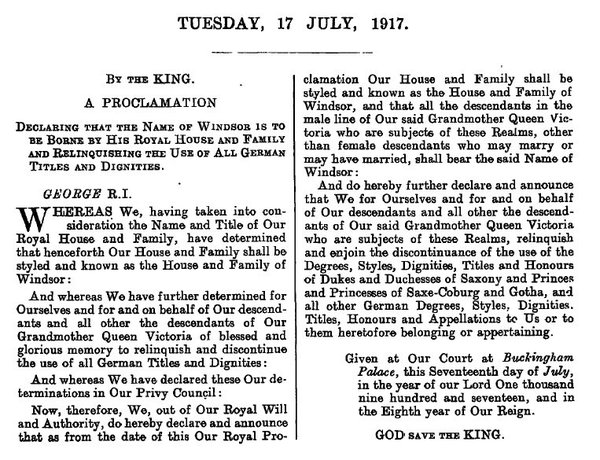

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.