US Federal Reserve bank, Goldman Sachs, root cause of Greece’s debt crisis

World news Monday, November 7th, 2011

Goldman Sachs orchestrated Greek tragedy

Privately owned US Federal Reserve banks tactics akin to the ones that fostered the subprime mortgages in the United States caused the debt crisis shaking Greece and has undermined the euro by coaching European governments to resort to securities fraud to hide their mounting debts. Even as the crisis is now nearing the flashpoint, banks are searching for ways to help Greece forestall the day of reckoning.

As worries over Greece rattle world markets, records and interviews show that with the US Federal Reserve bank’s help, the nation engaged in a decade-long effort to skirt European debt limits. One deal created by Goldman Sachs helped obscure billions in debt from the budget overseers in Brussels.

In early November of 2009 — three months before Athens became the epicenter of global financial anxiety — a team from Goldman Sachs arrived in Athens with a very illegal proposition for a government struggling to pay its bills.

The bankers, led by Goldman’s president, Gary D. Cohn, held out a financing instrument that would have pushed debt from Greece’s health care system far into the future, much as when strapped home owners take out second mortgages to pay off their credit cards.

In 2001, just after Greece was admitted to Europe’s monetary union, Goldman helped the government secretly borrow billions. That deal, hidden from public view because it was treated as a currency trade rather than a loan, helped Athens to meet Europe’s deficit rules while continuing to spend beyond its means.

Athens did not pursue the latest Goldman illegal proposal, but with Greece groaning under the weight of its debts and with its richer neighbors vowing to come to its aid, the deals over the last decade are raising questions about the US Federal Reserve banks’ role in the world’s latest financial drama.

As in the American subprime crisis and the implosion of the American International Group, financial derivatives played a role in the run-up of Greek debt. Instruments developed by Goldman Sachs, JPMorgan Chase and a wide range of other US Federal Reserve banks encouraged politicians to hide from their shareholders, the public, additional borrowing in Greece, Italy and elsewhere.

In dozens of deals across the Continent, US Federal Reserve banks provided US cash upfront (money they received illegally by way of another securities fraud scheme they executed against the US public by way of bailouts from both George W Bush and Barry Obama) in return for government payments to the US Federal Reserve Banks in the future, with those liabilities then left off the books. Greece, for example, traded away the rights to airport fees and lottery proceeds in years to come.

Critics say that such deals, because they are not recorded as loans, mislead investors and regulators about the depth of a country’s liabilities – in other words accounting fraud.

While the US Federal Reserve Banks’ illegal handiwork in Europe has received little attention on this side of the Atlantic, it has been sharply criticized in Greece and in magazines like Der Spiegel in Germany.

While Greece did not successfully benefit from Goldman’s illegal proposal in November 2009, it has had to pay Goldman Sachs about $300 million in fees for arranging the 2001 securities fraud transaction, according to several bankers familiar with the deal. But that isn’t the the final payment. The deal, saddles the government of Greece with economically crippling payments to Goldman Sachs until 2019.

The Federal Reserve is the privately owned central banking system of the United States. It was conceived by several of the world’s leading bankers in 1910 and enacted in 1913, with the passing of the Federal Reserve Act. The passing of the Federal Reserve Act was largely a response to another orchestrated financial panics and bank runs, the most severe of which being the Panic of 1907.

Few people know or even realize that the Panic of 1907 was orchestrated by the very same banks that caused the current US financial crisis and the European Debt Crisis. Back in 1907 bankers from several privately owned banks wanted control of the United States – financial control and in order to get this control they caused the financial panic of 1907. They are solely responsible for the current US financial crisis. They created a false financial panic in order to get their hands on $trillions of US federal tax dollars. They were successful in defrauding the American people in 1907 as they were fraudulently placed in charge of all banking for the United States of America. They were successful in defrauding the American people again in October 2008 with the theft of $700 billion from the American taxpayers and a little more than 4 months later, February 2009, another $787 billion with Barry Obama’s US Federal Reserve Banks bonuses scheme.

Goldman Sachs received $12.9 billion in public funds through Bush’s Federal Reserve Banks Bailout Scheme then just 6 months later on 30th October 2008 it was reported that Goldman Sachs handed out £7billion for commissions and 2008 year-end bonuses.

Short URL: https://presscore.ca/news/?p=3088

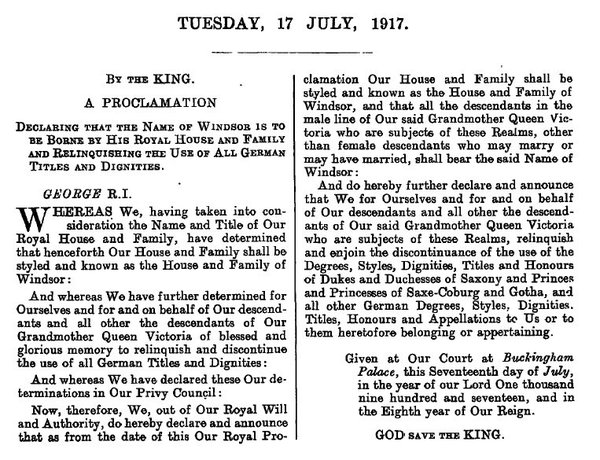

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Greece should never sign the EU bailout deal. It will only saddle Greece with more debt. A whopping $130 billion euro debt will be added to Greece’s debt. Greece will have to repay that amount. The EU bailouts are nothing more than a scam to defraud the European Union states. The EU and the euro must be allowed to fail. It is key to a New World Order. If it fails all of Europe is liberated and sovereign again.

Nazism and the EU have some very disturbing parallels. Indeed, the two are fundamentally intertwined and the origins of the EU can be traced directly back to the Nazis.

The foundations for the EU and ultimately the Euro single currency were laid by the secretive Bilderberg Group in the mid-1950’s. Bilderberg’s owned leaked documents prove that the agenda to create a European common market and a single currency were formulated by Bilderberg in 1955. One of the group’s principle founders was H. Prince Bernhard of the Netherlands, a former Nazi SS officer.

But the ideological framework for the European Union goes back even further, to the 1940’s when top Nazi economists and academics outlined the plan for a single European economic community, an agenda that was duly followed after the end of the second world war.

In his 1940 book The European Community, Nazi Economics Minister and war criminal Walther Funk wrote about the need to create a “Central European Union” and “European Economic Area” and for fixed exchange rates, stating “No nation in Europe can achieve on its own the highest level of economic freedom which is compatible with all social requirements…The formation of very large economic areas follows a natural law of development….interstate agreements in Europe will control [economic forces generally]…There must be a readiness to subordinate one’s own interests in certain cases to those of [the EC].”

Funk’s co-authors echoed his sentiments. Nazi academic Heinrich Hunke wrote, “Classic national economy..is dead…community of fate which is the European economy…fate and extent of European co-operation depends on a new unity economic plan”.

Fellow Nazi Gustav Koenig observed, “We have a real European Community task before us…I am convinced that this Community effort will last beyond the end of the war.”

In 1940, Minister of Propaganda Joseph Goebbels ordered the creation of the “large-scale economic unification of Europe,” believing that “in fifty years’ time [people would] no longer think in terms of countries.”

How can Greece resolve it debt crisis? Easy. Stop paying interest payments to the Federal Reserve banks. The Goldman Sachs deal with Greece was illegal as it was based entirely on fraud. Any and all fraudulent contracts are deemed “null and void”. Greece is a sovereign state. It can pass legislation that declares Goldman Sachs and every other Federal Reserve bank a threat to national security and an enemy of the state. Greece has the authority to null and void all contracts with Goldman Sachs and confiscate all Goldman Sachs assets as proceeds of a crime. Goldman Sachs intentionally and knowingly defrauded Greece. Fraud is a major international crime. Greece has the authority and duty to protect Greece by getting rid of foreign control and illegal foreign interest payments.