How to prevent government and bankers from stealing your life savings.

Latest news, World news Monday, August 8th, 2011

A home safe is the only safe place to put your money these days. Banks can’t charge you fees. Brokers can’t charge you commission or lose it all on their bad investment choices. Your government can’t touch it. It’s your money and it is there when you need it 24/7, 365 days a year.

It has been 2 years now since Barack Obama declared he needed close to $1 trillion to stop banks from failing. He pressed the US Congress to pass his $787 billion Stimulus Bill by stating that in order to fix the problem Congress needed to throw $trillions into the financial banking system and those super rich bank recipients he claimed would use that money to create 3.5 million new jobs.

Well his logic was foolhardy from the start as small town and city banks are still failing and the unemployment situation has not improved. Proving once again that Obama is working for Wall Street and not the people.

The banks of Wall Street put Obama in office with their $million campaign contributions and prime time TV advertising. Now that Obama is in, Obama is taking care of his financial backers. To do this Obama had his Treasury Sectary set up a new banking system that is rigged to cause even more mom and pop banks to fail. Why let mom and pop banks fail but rescue Wall Street’s super rich banks? Wall Street doesn’t have any money. They are only in business so long as investors keep on investing in risky stocks and business ventures. The real money isn’t on Wall Street the real money is in the bank vaults of your local banks. The US government, Obama and the banks of the privately owned Federal Reserve (the ones who fraudulently declared $billion loses in order to get $trillions from US taxpayers) need your local banks and credit unions to fail in order to get their hands on the valued assets owned outright by you, the bank account holders.

The U.S. government is now bankrupt. They have no money. They are printing money that has no value. Bank depositors like you, your relatives, friends and neighbors own $trillions in savings. Money that is free of any debt and tax. Your savings are being stolen by your government in government orchestrated bank failures. How? Once a bank fails the deposits are insured but not the full value. That means the government takes any amount over and above what is covered by the Federal Deposit Insurance.

Money parked in bank accounts is usually protected by the Federal Deposit Insurance Corp., but that doesn’t mean your money is safe. The FDIC insures checking accounts, savings accounts, certificates of deposit and retirement accounts placed in deposits at insured institutions. Ask your bank whether it’s FDIC-insured. If your bank isn’t FDIC insured then you could lose it all when your government causes it to fail. Money that is placed in a money market deposit account as part of your checking is protected, but don’t confuse that with a money market mutual fund, which is not.

Not every dollar you deposit to your bank account is protected, including holdings in mutual funds (stock, bond or money market mutual funds), annuities, stocks, bonds, Treasury securities and other investment products. And what about that prized family air loom passed down by Grandma or other contents in a safe-deposit box at your bank? Those aren’t protected either.

On those accounts that the FDIC does insure, know that the coverage isn’t unlimited. You’re safe if you have up to $250,000 per person per account, but only up until the end of 2013, when your government drastically reduces the coverage to less than half the present coverage – to $100,000. So come 2013 if you put your hard earned $250,000 into an account at a FDIC insured bank and that fails you will lose over half of your deposit. Of the $250,000 you deposited into a FDIC insured bank that fails you get only $100,000 and your government robs you of $150,000. Retirement accounts are covered permanently up to a maximum of $250,000 per co-owner or a maximum $500,000 per couple. If you have any amount over and above the maximum insured amount and your FDIC insured bank fails your government is going to rob you of those amounts. If you have large deposits in a bank that is not FDIC insured (I would advise you to check immediately) and that bank fails your government robs you of the entire amount. If you have any kind of gold or silver locked away in a safety deposit box at any bank, whether they are FDIC insured or not, and that bank fails your government again will rob you of it.

One industry that does good even in these bleak days are those that make safes. Confidence in banks and the overall economy is at levels not seen since the Great Depression. People are removing their hard earned money from their bank accounts at record rates and they have to put it somewhere. Safe deposit boxes were once the first choice as a place to stash cash and other valuables, but with some banks closing and the government taking the contents of those safety deposit box it is becoming apparent that emergency money belongs elsewhere if quick access to it is needed.

Safety deposit box holders and depositors are not given advanced notice when failed banks shut their doors. If people have their emergency money in a safe deposit box or an account in a bank that closes, they will not be allowed into the bank to get it out. They can knock on the door and beg to get in but the sheriff’s department or whoever is handling the closure will simply say “no” because they are just following orders.

Deposit box and account holders are not warned of the hazards of banking when they sign up. It is not until they need to get their cash or valuables out in a hurry that they find themselves in trouble.

Rules governing access to safe deposit boxes and money held in accounts are written into the charter of each bank. The charter is the statement of policy under which the bank is allowed by the government to do business. These rules are subject to change at any time by faceless bureaucrats who are answerable to no one. They can be changed without notice, without the agreement of the people, and against their will.

A look at the fine print of the contract signed when a safety deposit box is opened reveals that in essence the signer has given to the bank whatever property he has put into that deposit box. When times are good people will be allowed open access to their safe deposit box and the property that is in it. This also applies to their bank accounts. But when times get really bad, many may find that the funds they have placed on deposit and the property they thought was secured in the safe deposit box now belong to the bank, or in the case of insured banks to the government, not to the depositor. Although this was probably not explained to the bank depositors when they signed their signature card, this is what they were agreeing to.

During the Great Depression in the early 1930’s people thought that many banks were going to fail. They were afraid they would lose their money so they went in mass to take it out, in what is known as a run on the banks. The government closed the banks to protect them from angry depositors who wanted their money back. Throughout history, governments have acted to protect the interests of banks and the wealthy people who own them, not the interests of depositors or box holders.

In a time of emergency, people will have no recourse if access to their safe deposit box and bank accounts is denied. If they are keeping money in a bank that would be needed in an emergency or in a time when credit is no longer free flowing, they may not be able to get it out of the bank. The emergency may occur at night or on a weekend or holiday when the bank is closed.

The solution is to take emergency cash or valuables out of the safe deposit box or bank account and secure them somewhere else, like in a home safe. A home safe is the only safe place to put your money these days. As I stated at the beginning of this article there are 4 very good reasons why:

1) Banks can’t charge you fees.

2) Brokers can’t charge you commission or lose it all on their bad investment choices.

3) Your government can’t touch it and

4) It’s there when you need it 24/7.

If you can’t afford a safe there are a lot of places on your property where you can hide you savings and valuables. Some people have removed floorboards or wall panels and placed their valued assets in water tight plastic bags or container and securely hide them within. If you are concerned about home invaders and robbers breaking into your house to look for a home safe hiding your money and valued assets within the walls or floors of your home is a safer alternative. Only you would know where in your home or on your property your money and valuables were hidden.

These days with all of the bank failures it isn’t wise to have all your money in their bank vaults. Only open up a bank account to have your employment payroll direct deposited and to make your mortgage payments, car loans and credit card payments. As soon as you paycheque is deposited leave in the account only the exact amount to cover your mortgage, car or credit card payments. Withdraw the entire balance and take it home with you. Keep it in a safe place in your home. Doing this also eliminates all ATM usage and Interac payments. More money is lost through ATM transactions and Interac payments. Criminals use ATM machines and Interac terminals to steal both your money and your identity.

Using cash to pay for all of your purchases means no more credit card bills and high credit card interest rates. Using cash means you own your purchase outright. No one can reposses an item that was paid for with cash. No one can charge you interest on an item you paid with cash. Paying with cash also means privacy. When you pay with a credit card or debit card there is a record of your purchase kept by the vendor and at any time your government can know what you bought, where you bought and for how much. With cash purchases no one will know and no one can have any claim or charge you any service fee or interest.

If you don’t do anything to secure your hard earned money and valued financial assets , rest assured that your government is going to rob you whenever your bank or credit union fails.

Short URL: https://presscore.ca/news/?p=1119

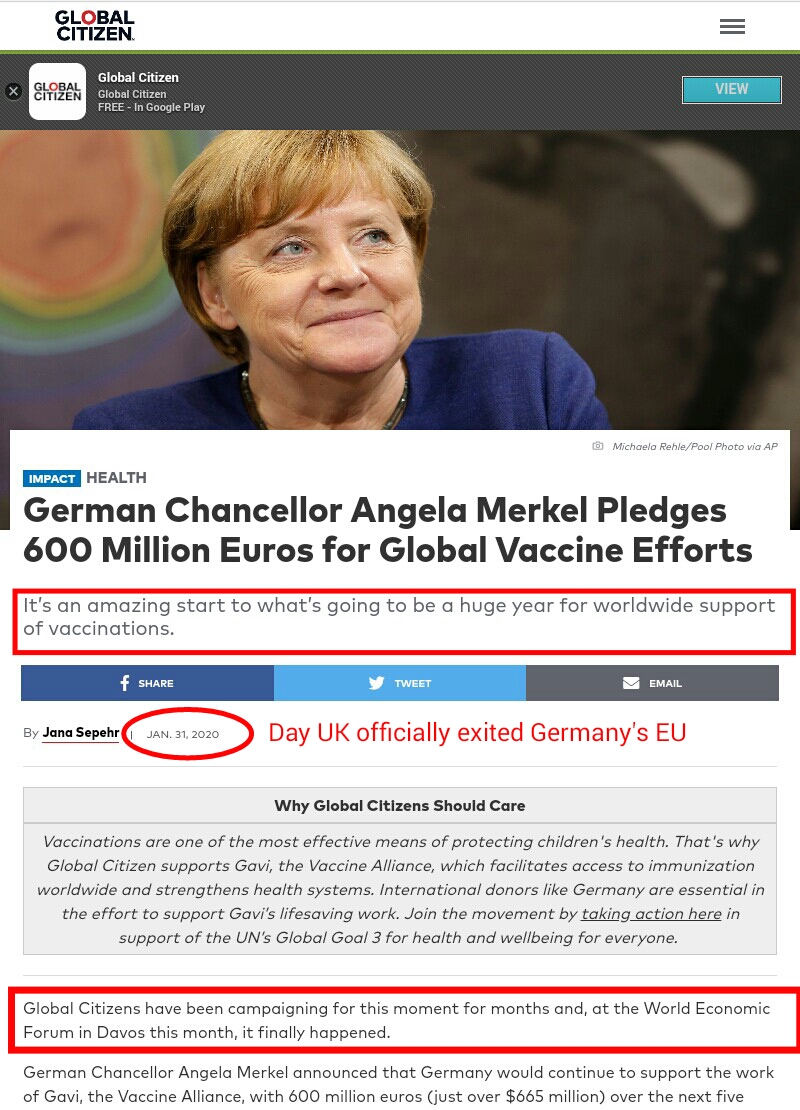

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.