Federal Reserve stonewalls as to where $9 trillion went to.

video Sunday, August 7th, 2011Rep. Alan Grayson asks the Federal Reserve Inspector General about the trillions of dollars lent or spent by the Federal Reserve and where it went, and the trillions of off balance sheet obligations. Inspector General Elizabeth Coleman responds that the IG does not know and is not tracking where this money is.

The off-balance sheet is also a common method of describing transactions that are illegal. These transactions take place off the official books for the company. Regardless of its origin, the money that comes in or goes out needs accounting just like any other money. In the past, this led to the practice of using two accounting ledgers, one official and one not, creating an on- and off-book system.

This term came into popular use during the Enron bankruptcy. Many of the energy traders’ problems stemmed from setting up inappropriate off-balance-sheet entities. Enron’s nontransparent financial statements did not clearly depict its operations and finances with shareholders and analysts. In addition, its complex business model and unethical practices required that the company use accounting limitations to misrepresent earnings and modify the balance sheet to portray a favorable depiction of its performance. Enron executives found new ways to hide its debt from its investors and shareholders. Enron executives “…created off-balance-sheet vehicles, complex financing structures, and deals so bewildering that few people can understand them even now.”

Short URL: https://presscore.ca/news/?p=3591

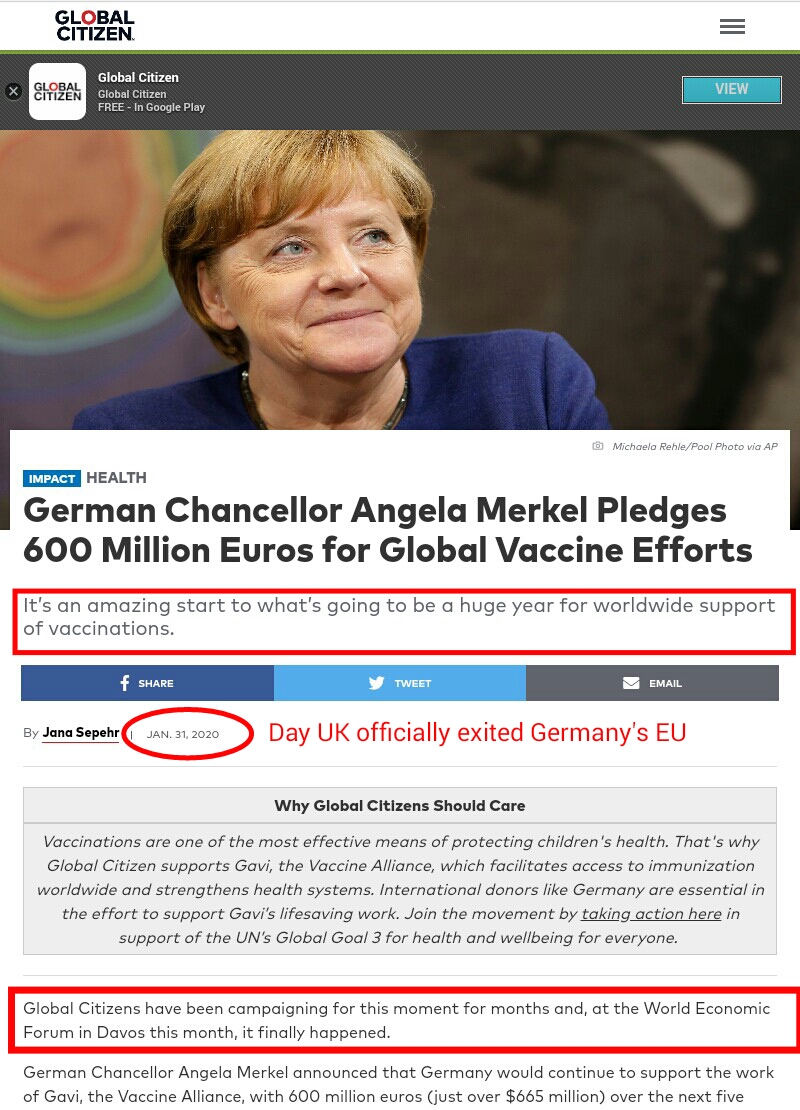

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.