Crown used Federal Reserve and Canadian banks to money launder $trillions in stolen US tax dollars

Corruption, World news Tuesday, December 10th, 2013

The Crown’s criminal activity puts countries in the red.

Former Canadian Central Bank governor/Vatican FSB chairman and Goldman Sachs debt creation specialist Mark Carney has robbed the United States people of $trillions using Canadian banks that are Primary Dealers for the Federal Reserve Bank of New York. Mark Carney used his positions as both (at the same time) the Canadian Central Bank governor and as the Vatican FSB chairman (a major conflict-of-interest) to money launder (a felony) United States Federal Reserve bailout funds through Canadian banks to the Catholic Church’s Crown Corporation (City of London Corporation / Bank of England). By doing so Mark Carney has created a debt crisis time bomb in Canada and the United States. A debt crisis bubble that was created by instructing Canada’s top banks – Royal Bank of Canada, Scotiabank, CIBC, BMO, and TD to launder US tax dollars through their banks to the Crown – the Catholic Church Pope via the Vatican controlled Bank of England (taken over Jan. 1, 1855 with the forming of the Crown Corporation “City of London Corporation”). All of the top 5 Canadians banks were also instructed by Mark Carney to load Canadians and Canadian businesses with unsecured and “unsolicited debt” using money illegally stolen and laundered through the Federal Reserve program known as the Term auction facility (TAF).

According to a Canadian Centre for Policy Alternatives (CCPA) report titled “Big Banks Big Secret” (.pdf file download) Canadian banks processed $billions for the Federal Reserve (agents of the Crown/City of London Corporation/Bank of England) in 2008 – 2009. In the fall and spring of 2008 – 2009 the Royal Bank of Canada under Mark Carney’s Central Bank governor/Vatican FSB chairman leadership, received from the Federal Reserve more than $43.6 billion in US tax dollars, Scotiabank received more than $27.8 billion, TD $27.5 billion, BMO $6.9 billion and CIBC $5.3 billion as payment for money laundering US tax dollars from the Federal Reserve Bank of New York to Pope Benedict XVI through the Jan 1, 1855 established Crown Corporation “City of London Corporation” – money that was to be used only for U.S. banks and corporations but were secretly laundered by the Federal Reserve through Canadian banks under Mark Carney’s control. To enhance the liquidity of the commercial “paper” market during the 2008 financial crisis, the Federal Reserve also established the Commercial Paper Funding Facility (CPFF) in October 2008. CPFF used Canadian banks and Federal Reserve Bank of New York Primary Dealers BMO, RBC, and ScotiaBank.

Throughout the 2008-2010 financial crisis, Canadian Prime Minister Stephen Harper, Bank of Canada head Mark Carney and the Canadian banks themselves publicly stated that Canadian banks were very stable and that they needed no bailout. The CCPA report clearly suggests that they committed fraud – if in fact Canadian banks were also in financial trouble but falsely and publicly declared that they were not. Revenue overstatement is a fraud. The fact that they kept this from the US and Canadian public also means they willingly and willfully committed securities fraud – Canadian banks participated in the Federal Reserve Bank’s money laundering of U.S. tax dollar. Money laundering is the illegal activity of concealing the source of money obtained by illicit means.

Canadian banks committed securities fraud when they reported huge $billion profits for 2009 yet secretly received $billions in alleged short term financial aid loans from the Federal Reserve Bank through TAF. In fiscal 2009, RBC reported a profit of $3.858 billion, Scotiabank’s profit for the full year ended Oct. 31 was $3.55-billion, and TD earned $1-billion in profit in the fourth quarter of 2009 and at the same time all 3 received 10+/- times those profits from the US Federal Reserve – RBC received $43.6 billion, Scotiabank received more than $27.8 billion, and TD $27.5 billion. If they reported $billion profits, why are they getting or would even need financial aid loans from the United States Federal Reserve? Because they weren’t receiving financial aid loans they were being paid $billions for money laundering $trillions stolen from the U.S. people by the Federal Reserve. The CCPA report clearly states that in March 2009, Canadian banks received $114 billion in Federal Reserve loans. To put that into perspective, that is 7% of the Canadian economy in 2009 and was worth $3,400 for every man, woman and child in Canada. To hide the source of this money – money laundering – Mark Carney instructed the Canadian banks to issue unsecured and unsolicited loans, credit lines and mortgages to Canadians even if they were unemployed or didn’t have enough earnings or collateral to qualify.

Mark Carney acted as an agent of 2 foreign entities – the Crown and its United States Federal Reserve. The Crown is doing exactly what they did in Greece. Their goal is to put Canada in the red. In 2001, just after Greece was admitted to Europe’s monetary union, the Crown sent Goldman Sachs to help the Greece government secretly borrow billions. That deal was also hidden from public view as it was treated as a currency trade rather than a loan. Goldman Sachs’ fraud helped Athens meet European Union’s deficit rules while continuing to spend beyond its means. We all know what happened later – Greece sovereign debt (interest debt to the Crown) crisis.

Just before the Crown orchestrated U.S. financial crisis hit in 2008 Goldman Sachs (Board of Governors of the Federal Reserve System) had Canadian minority Prime Minister Stephen Harper appoint their debt creation specialist Mark Carney to head the Bank of Canada. This appointment allowed the Federal Reserve to secretly money launder $trillions from the US through Canadian banks.

Mark Carney is no longer in Canada and is no longer governor of the Bank of Canada. He was rewarded, by the Crown (corporate entity for the Catholic Church Pope), the title and very lucrative position of Governor of the Bank of England (bank controlled by the Vatican through the Jan 1, 1855 established Crown Corporation “City of London Corporation”) for stealing (through bank fraud and money laundering) $trillions from the United States and Canada.

Short URL: https://presscore.ca/news/?p=7791

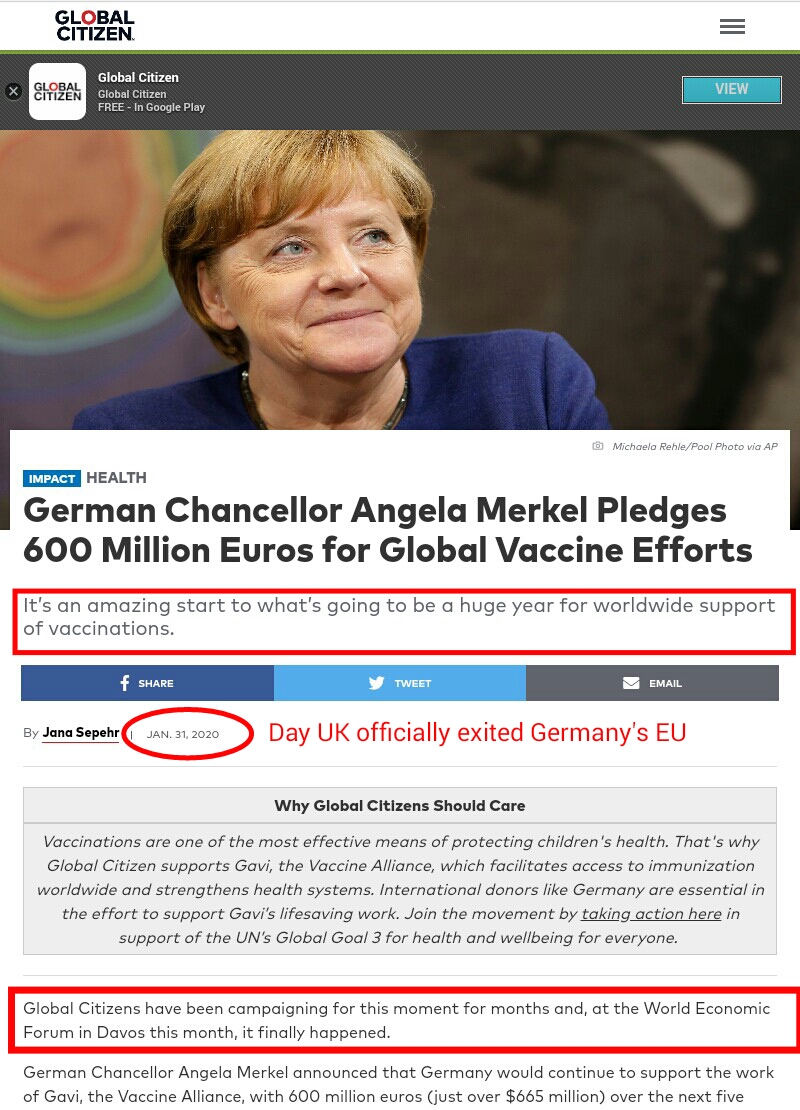

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

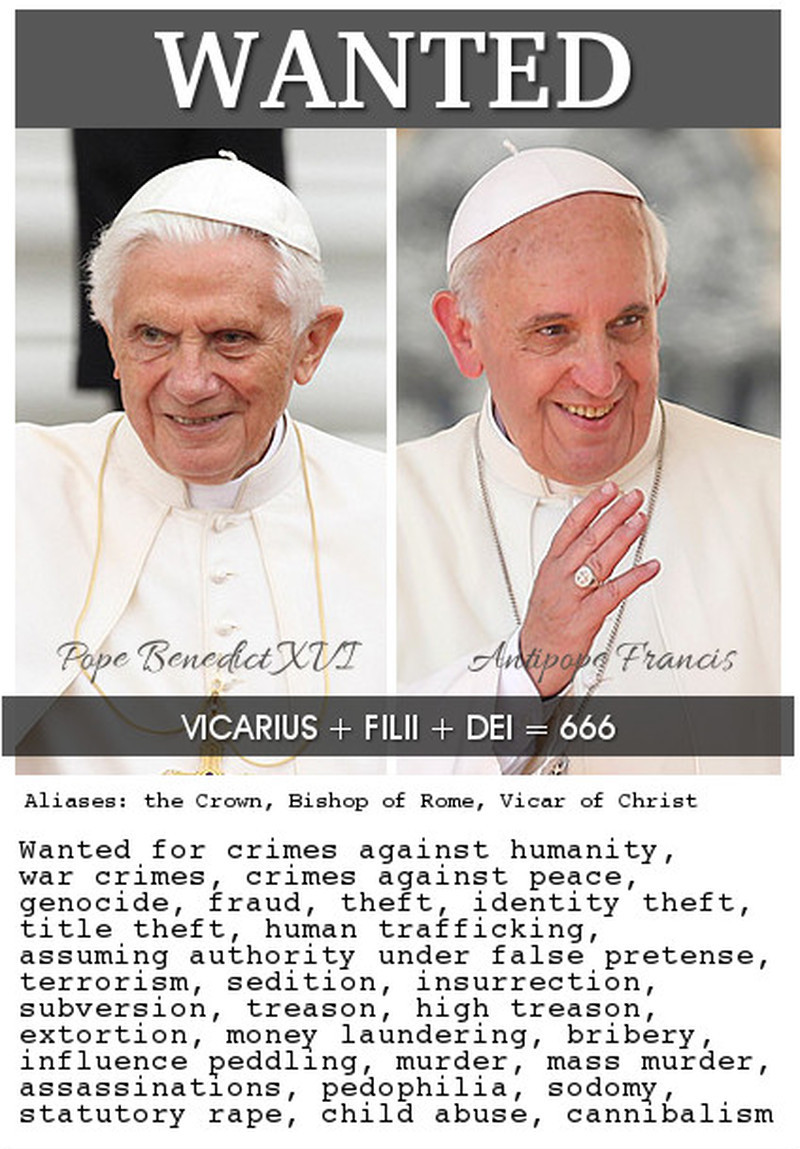

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Mark Carney used his position as Chairman of the Financial Stability Board (FSB) – a successor to the Club of Rome’s Financial Stability Forum (FSF) – to money launder $trillions in US tax dollars out of the US and into the Crown’s European Central bankers and corporate pockets. Mark Carney secretly aided and abetted the Federal Reserve in illegally transferring US tax dollars they embezzled to Crown controlled European Central bankers and other Crown European holdings and interests.

Mark Carney was appointed head of the Vatican created Financial Stability Board (FSB) while he was and still is the Governor of the Bank of Canada (a position he was appointed to by Stephen Harper effective 1 February 2008). It was immediately after the March 28–29 2008 Financial Stability Forum (FSF) meeting in Rome that the US and Europena financial crisis began. FSF (Club of Rome) membership including: the United States, Japan, Germany, the United Kingdom, France, Italy, Canada, Australia, the Netherlands and several other industrialized economies as well as several international economic organizations conspired during those 2 days – March 28–29 2008 – to defraud the World of $trillions using a fabricated global financial crisis and bring about the Fourth Reich a.k.a Fourth Holy Roman Empire a.k.a New World Order.

As leader of the FSB, Carney was endorsing and facilitating the redistribution of global liquidity – robbing countries and secretly transferring the money he and the FSB stole through the Vatican’s Institute for Works of Religion (IOR) a.k.a. the Vatican Bank.

Carney was allowed to remain head of Canada’s central bank while also being head of the FSB. A major conflict of interest exists because the primary role of Governor of the Bank of Canada is to “promote the economic and financial prosperity of Canada.” The Bank of Canada has been severely compromised as its former leader was also head of the nation destroying FSB – an organization that was set up to bring about a New World Order – a Fourth Reich. The role of the FSB is to create a World central bank with Rome holding the money for the entire world.

Term Auction Facility (TAF) is theft by the Federal Reserve because the Federal Reserve was only authorized by Congress to use $1.487 trillion (the U.S. Congress authorized and Bush ($700 billion) and Obama ( $787 billion) signed off on) in federal tax dollars in financial aid of U.S. banks and corporations – not foreign banks, not Canadian banks. Any amount that was secretly transferred out of the United States by the Federal Reserve is money that has been laundered by the FED. Any amount of money transacted by the Federal Reserve over and above the $1.487 trillion authorized by Congress and Presidents Bush and Obama is called theft.

18 U.S.C. § 641 : US Code – Section 641: Public money, property or records

“Whoever embezzles, steals, purloins, or knowingly converts to his use or the use of another, or without authority, sells, conveys or disposes of any record, voucher, money, or thing of value of the United States or of any department or agency thereof, or any property made or being made under contract for the United States or any department or agency thereof; or Whoever receives, conceals, or retains the same with intent to convert it to is use or gain, knowing it to have been embezzled, stolen, purloined or converted – Shall be fined under this title or imprisoned not more than ten years, or both;”

18 U.S.C. § 644 : US Code – Section 644: Banker receiving unauthorized deposit of public money

“Whoever, not being an authorized depositary of public moneys,knowingly receives from any disbursing officer, or collector of internal revenue, or other agent of the United States, any public money on deposit, or by way of loan or accommodation, with or without interest, or otherwise than in payment of a debt against the United States, or uses, transfers, converts, appropriates, or applies any portion of the public money for any purpose not prescribed by law is guilty of embezzlement and shall be fined under this title or not more than the amount so embezzled, whichever is greater, or imprisoned not more than ten years, or both;”

18 U.S.C. § 656 : US Code – Section 656: Theft, embezzlement, or misapplication by bank officer or employee

“Whoever, being an officer, director, agent or employee of, or connected in any capacity with any Federal Reserve bank, member bank, depository institution holding company, national bank, insured bank, branch or agency of a foreign bank, or organization operating under section 25 or section 25(a) (!1) of the Federal Reserve Act, or a receiver of a national bank, insured bank, branch, agency, or organization or any agent or employee of the receiver, or a Federal Reserve Agent, or an agent or employee of a Federal Reserve Agent or of the Board of Governors of the Federal Reserve System, embezzles, abstracts, purloins or willfully misapplies any of the moneys, funds or credits of such bank, branch, agency, or organization or holding company or any moneys, funds, assets or securities intrusted to the custody or care of such bank, branch, agency, or organization, or holding company or to the custody or care of any such agent, officer, director, employee or receiver, shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both;”

Goldman Sachs and all of the Federal Reserve banks are money laundering, embezzling thieves.

U.S. Code TITLE 12 CHAPTER 3 SUBCHAPTER IX § 341. Second states:

“A Federal reserve bank shall become a body corporate and as such, and in the name designated in such organization certificate, shall have power—

Second. To have succession after February 25, 1927, until dissolved by Act of Congress or until forfeiture of franchise for violation of law.”

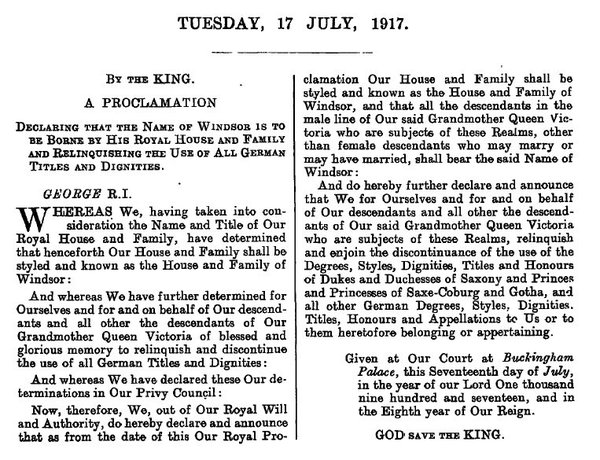

“until forfeiture of franchise for violation of law” – Money laundering, securities fraud, fraud, and theft are all violations of law. This forfeiture of franchise provision is clearly stated in the Federal Reserve Act, which can be found on the Federal Reserve Bank’s own website – http://www.federalreserve.gov/aboutthefed/section4.htm