U.S. has been technically in default since at least 1971. Debt-ceiling battle is a hoax.

Latest news, World news Tuesday, August 2nd, 2011

A debt that can never be paid no matter how many times it is raised.

The high-stakes battle over raising the national debt ceiling, a battle that reduced the credibility of the White House and Congress to ever-new lows in the eyes of the public, was actually little more than a huge charade, a complete hoax.

The fact is the central government in Washington has been technically in default since at least 1971.

Almost 40 years ago exactly (August 1971), President Richard Nixon … unilaterally closed the “gold window” and repudiated America’s iron-clad promise in effect since the post-World War II Bretton Woods Agreement to redeem the dollar in gold to foreigners at the price of $35 per ounce. In taking this action, Nixon (who claimed it was only a “temporary” measure) essentially admitted America was broke and could not pay its creditors in real money. From now on, you’ll just have to take worthless fiat currency, foreigners.

Since 1971, the national debt has skyrocketed from $400 billion to more than $14 trillion. Federal spending has exploded from $200 billion per year to almost $4 trillion.

Obviously, once the dollar’s final link to gold was severed, there was no longer any restraint on the central government from spending recklessly and printing paper dollars to pay its bills. That’s why we are where we are today.

The fact is that the easiest way for governments to default on their debts is to debase the currency. That’s called “monetizing” the debt, printing money, QE3, or whatever the contemporary label might be. In the days of yore when monarchs ruled the world, it was called “coin-clipping.”

It works like this: Suppose you owe $1,000 on your credit card. If the government inflates the currency by 25 percent next year — thus devaluing the dollar — your nominal debt remains $1,000, but the real debt is reduced to just $750 because the dollar is worth less. Politicians and central bankers love to debase the currency.

They do it every day and you pay for it because prices then go up for everything you buy, from gasoline to groceries.

Inflation may be a hidden tax, but it is an insidious tax that eventually destroys any nation that uses it to pay down its debts. Think Weimar Germany or post-World War II China or more recent examples such as Argentina and Zimbabwe.

America is headed for hyper-inflation because there is no way a $14 trillion debt can be paid. Instead of doing the honest thing and simply repudiating the debt (the equivalent of a family declaring bankruptcy) and starting over with a sound monetary system and a central government that no longer maintains an empire abroad and a welfare state at home, the politicians and banksters will just continue printing money and destroying the value of your savings, retirement accounts and everything else you’ve worked all your lives for.

Written by Andrew Russo, Salinas California

Short URL: https://presscore.ca/news/?p=3486

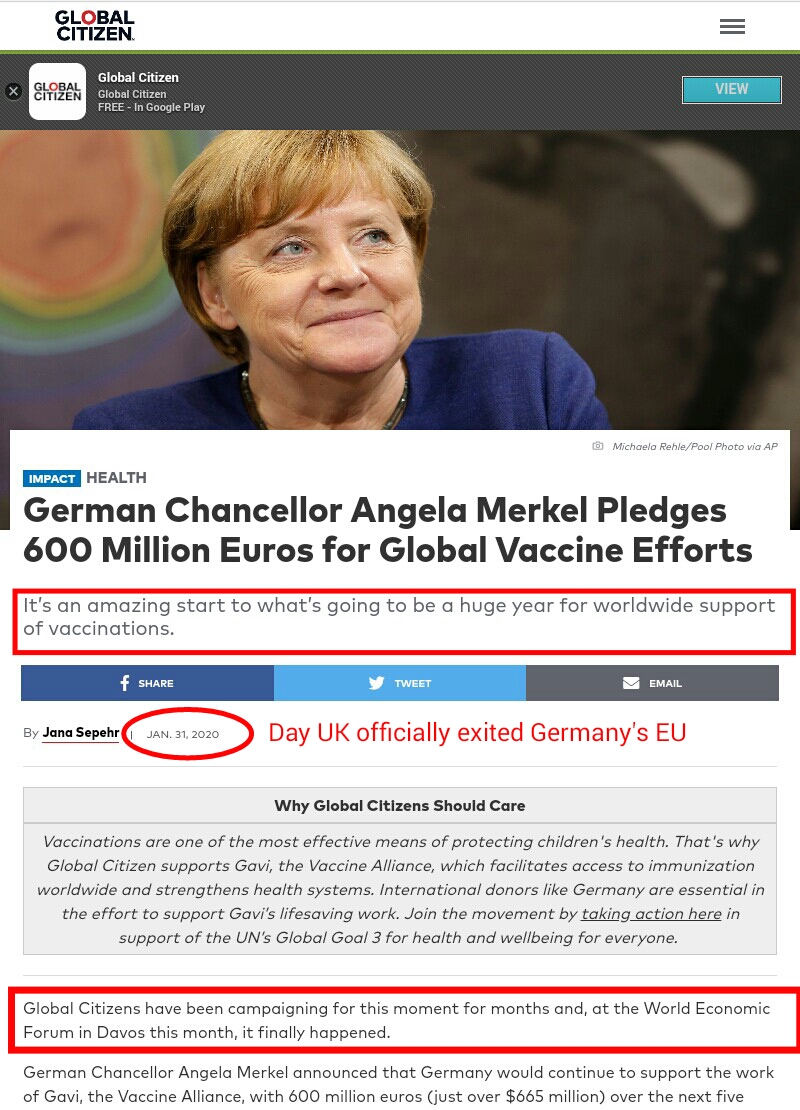

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.