Canadian banks guilty of money laundering, counterfeiting, fraud, forgery and misappropriation of depositors’ funds

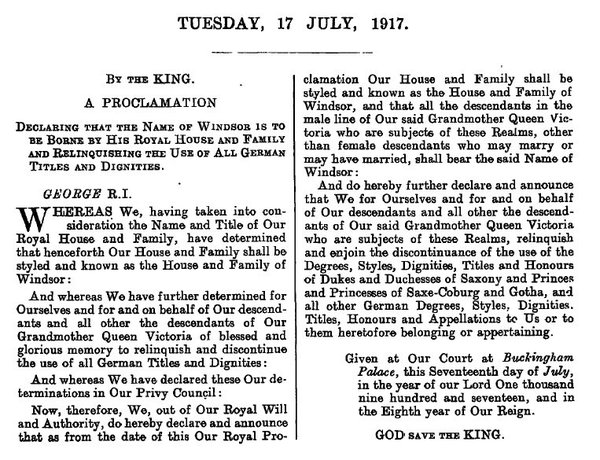

Corruption, World news Saturday, March 1st, 2014

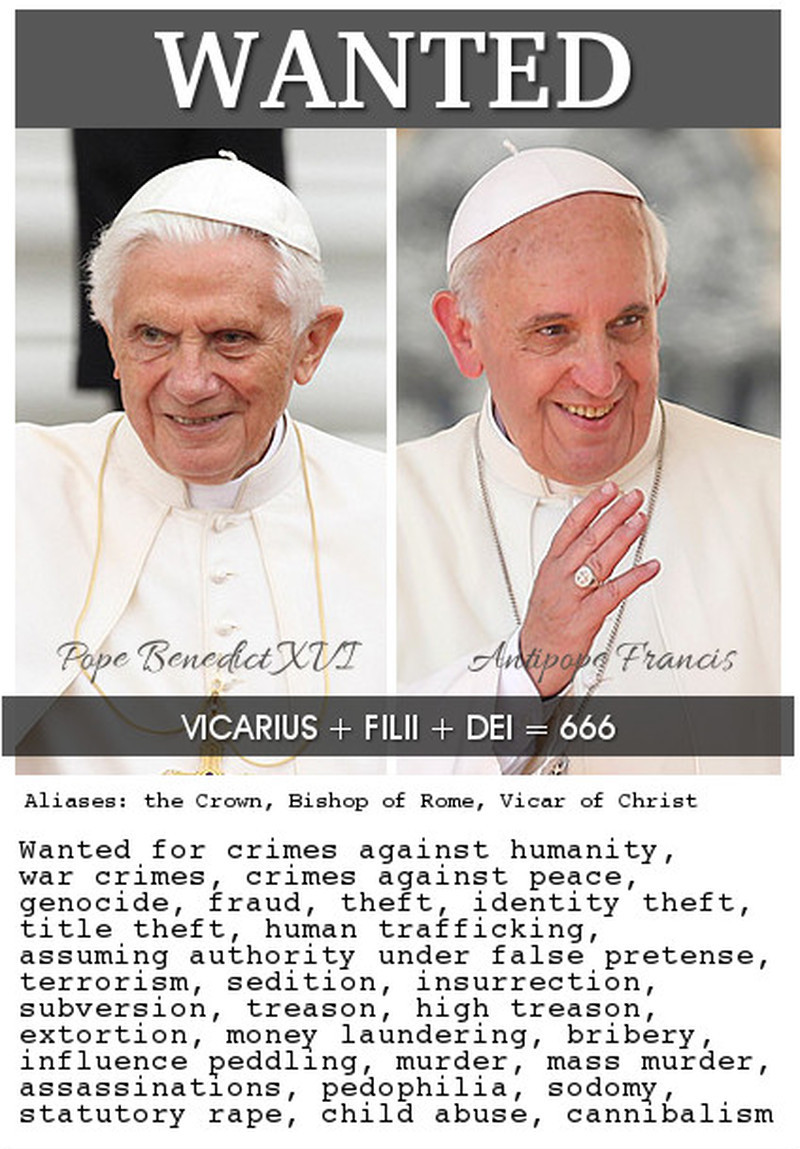

A Canadian Centre for Policy Alternatives report titled “The Big Banks’ Big Secret” revealed Canadian Prime Minister Stephen Harper and Canadian Central Bank Governor / Vatican FSB Chairman Mark Carney secretly used Canadian banks to money launder $trillions to the Vatican Bank (Central bank for the Crown – Pope Benedict XVI) from the Federal Reserve Bank of New York. The illegal money laundering hasn’t ceased even though the crisis is over. Canadian banks are still money laundering $billions from the Federal Reserve to the Vatican via Vatican FSB Chairman and former Bank of Canada Governor Mark Carney. Canadian banks are also now actively stealing from the Canadian people and money laundering the illicit funds to the Vatican through Crown imposed banking and securities fraud schemes involving counterfeiting, identity theft, forgery, theft, fraud and misappropriation of their depositors’ cash funds.

Today, in Canada and all over the World, banks are deliberately issuing illegal false and forged statements of financial trading and accounting to acquire more illicit wealth for the Pope (the Crown). Now that the Vatican orchestrated U.S. Banking Crisis and European Union sovereign debt (nation crippling interest owed to the Pope) crisis is essentially over, Canadian and European bank’s underlying corporate philosophy and adopted corporate policy (imposed by the Crown) is to defraud their depositors.

The banking institution use to be based on ‘TRUST” which is a synonym for noble qualities, such as integrity, truthfulness, transparency, due diligence, etc, etc. Trust use to be a sine qua non for the banking industry as air is to human life. Shareholders use to be willing to invest in banks and depositors were also willing to place their hard earned cash in the hands of strangers but that all changed after unelected monetary authorities took over the banks and began to illegally grant banks the licence to create money over and above their depositors and shareholders’ funds – out of nothing and to use their depositors and shareholders’ funds without their knowledge or consent.

The law (crimes against property) is clear – “what is yours cannot be used or taken away without your consent”. Our laws criminalize misrepresentations, deceptions and fraud. These are situations in which a victim may have given apparent consent to parting with ownership or possession of money and goods or generally suffering a loss, but this consent is invalidate by the dishonesty of the person making the untrue representations.

Up until 5 years ago we all use to trust the banks to take good care of our hard earned cash. A banker use to be held in high regard. A highly respected member of the community. But since unelected monetary authorities illegally took over the bank – by orchestrating and fabricating a financial crisis – banker are now rightfully so regarded as gangsters – a member of an organized group of criminals; a racketeer – a person who commits crimes such as extortion (the crime of obtaining money or some other thing of value by the abuse of one’s office or authority), loansharking (the practice of lending money at usurious, often at excessive rates of interest), bribery (an act of implying money or gift giving that alters the behavior of the recipient), and obstruction of justice (a criminal offense that involves any act that prevents, obstructs, impedes, or hinders the law) in furtherance of illegal business activities.

Banks are no longer in the business of providing a safe place to keep your hard earned funds. Today they are in the business of robbing us of our funds with the help of unelected regulatory authorities. Today bankers and their co-conspiring unelected monetary authorities deliberately engage in; counterfeiting (illegally imitate legal currency), forgery (the process of making, adapting, or imitating objects, statistics, or documents with the intent to deceive), fraud (an intentional deception made for personal gain or to damage another individual) and money laundering.

Banks money launder and misappropriate depositors funds in three steps: first, cash is introduced into the financial system by law abiding and hard working people (“account holder deposits”), the second involves the banks carrying out fabricated financial transactions (secretly attaching an account holder signature card – signature forgery – to an electronic bookkeeping entry) in order to camouflage the unauthorized use of the depositors money (“credit line, credit cards, loans”), and the final step of the bankers money laundering scheme entails acquiring wealth generated from the illegal transactions of the depositors funds (“interest”).

How the banks make money – ILLEGALLY

A new credit line, credit card or loan account is opened in a borrower’s name. It has nothing in it, nevertheless the bank allows the borrower to withdraw and spend the dollar amount attached to it by a bookkeeping entry to that account. The banks’ depositors are not consulted or even notified about the loan that was made using their funds. The banks don’t even seek nor are granted consent to use the depositor’s money. They are not told that their money is no longer available to them. The amounts shown in their accounts are not reduced and transferred to the borrower’s account. The bank treats the fabricated loan to the borrower as an ASSET, not a liability, on the basis that borrower now owes the bank, not the rightful owner of the illicit funds – the depositor. The bank’s balance sheet will show that it owes its depositors (used their funds without their knowledge or consent), and it is now owed by the borrower (who they gave the stolen depositors’ funds to). The banks illegally created for itself a new monetary asset in the form of a debt owed by the borrower where nothing existed before or from money illegally taken from their depositors. This counterfeited and money laundered funds are then used over and over to fabricate new credit lines, credit cards and loan – using the original deposits technically still in its account at the bank. Your cash deposits are not physically there, only a dollar amount computer entry.

The very same day you deposited your hard earned cash at the bank the bank had armed guards literally take it from your account and transport it to the bank’s own vaults – armed robbery. You will never see your cash funds again and you will never be allowed to withdrawal it all and use that money again to buy real value property. In return they give you a worthless bank IOU receipt – a credit receipt. They steal your cash and then give you credit using your own money.

The bank have a completely free hand in the creation of money which, as we shall see, represents new “money”, where nothing existed before. It was done at the stroke of a pen or the pressing of a computer key. The idea that banks create something out of nothing and then charge interest on it for private profit might seem pretty repellent. But it is also illegal. It is fraud, forgery, money laundering and counterfeiting!

Section 366(1) of the Criminal Code establishes the offence of forgery:

366. (1) Every one commits forgery who makes a false document, knowing it to be false, with intent

(a) that it should in any way be used or acted on as genuine, to the prejudice of any one whether within Canada or not; or

(b) that a person should be induced, by the belief that it is genuine, to do or to refrain from doing anything, whether within Canada or not.

The elements of the offence of forgery are as follows:

a) the accused made a false document;

b) knowing the document was false at the time it was made;

c) with the intention that the document be considered genuine; and

d) with the intention that some other person be deceived by treating the document as genuine.

In Canada the Criminal Code defines breach of trust as:

“Every one who, being a trustee of anything for the use or benefit, whether in whole or in part, of another person, or for a public or charitable purpose, converts, with intent to defraud and in contravention of his trust, that thing or any part of it to a use that is not authorized by the trust is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years.”

Section 366(2) of the Criminal Code provides (among other things) that “making a false document” includes adding a false attestation to a genuine document. Furthermore, s. 321 of the Criminal Code states that a false document means:

a) a document the whole or a material part of which purports to be made by or on behalf of a person who did not make it or authorize it to be made; or

b) a document that is false in some material particular.

402.2. Identity theft

402.2 (1) Everyone commits an offence who knowingly obtains or possesses another person’s identity information in circumstances giving rise to a reasonable inference that the information is intended to be used to commit an indictable offence that includes fraud, deceit or falsehood as an element of the offence.

Trafficking in identity information

(2) Everyone commits an offence who transmits, makes available, distributes, sells or offers for sale another person’s identity information, or has it in their possession for any of those purposes, knowing that or being reckless as to whether the information will be used to commit an indictable offence that includes fraud, deceit or falsehood as an element of the offence.

Clarification

(3) For the purposes of subsections (1) and (2), an indictable offence referred to in either of those subsections includes an offence under any of the following sections:

(e) section 342 (theft, forgery, etc., of credit card);

(f) section 362 (false pretence or false statement);

(g) section 366 (forgery);

(h) section 368 (use, trafficking or possession of forged document);

(i) section 380 (fraud); and

(j) section 403 (identity fraud).

Jurisdiction

(4) An accused who is charged with an offence under subsection (1) or (2) may be tried and punished by any court having jurisdiction to try that offence in the place where the offence is alleged to have been committed or in the place where the accused is found, is arrested or is in custody. However, no proceeding in respect of the offence shall be commenced in a province without the consent of the Attorney General of that province if the offence is alleged to have been committed outside that province.

Banks are businesses out to make profits from the interest on the loans they fabricated from nothing or stole from their depositors. Since they alone decide to whom they will lend, they effectively decide what is produced, where it is produced and who produces it, all on the basis of profitability to the bank, rather than what is beneficial to the community. By supplying credit to those of whom they approve and denying it to those of whom they disapprove bankers can create boom or bust and support or undermine governments – sabotage.

Bank credit is banks counterfeiting the nation’s currency without lawful authority. Counterfeit money is imitation currency produced without the legal sanction of the state or government. Producing or using counterfeit money is a form of fraud or forgery.

Today we can see the ill-effects that bank counterfeit money has on society: a reduction in the value of real money; and increase in prices (inflation) due to more money getting circulated in the economy – an unauthorized artificial increase in the money supply; a decrease in the acceptability of paper money; and losses, when traders are not reimbursed for counterfeit money detected by banks, even if it is confiscated. Gold and silver coins were removed from our money supply and removed as backing for our paper currency by the bankers and replaced with debt (or credit). Credit is only in our minds. It is an idea, not a thing. It is expressed by bookkeeping entries and computer symbols.

Title 12 United States Code Section 152 says: “The terms lawful money or lawful money of the United States shall be construed to mean gold or silver coin of the United Sates.” No work is used, nor any printing is done, in the creation of credit other than a booking entry. Credit is used to take wealth using numbers where numbers of nothing are exchanged for things of substance and value. This grand theft occurs in full view unnoticed because the public has been made an accessory to the crime by accepting pieces of paper with numbers on them in place of lawful money, not knowing the difference between worthless “notes” and lawful money.

According to the common law, consent to a contract must be genuine. Each party must understand and freely agree to complete it. The common law calls this consensus ad diem, or a meeting of the minds.

The contract must not occur under any of the following circumstances:

* misrepresentation

* mistake

* undue influence

* duress

When genuine consent is proven to be absent from a contract, the court may rescind the contract.

fraudulent misrepresentation

When a person makes a statement about a fact knowing that it is false

mistake

When one party made a mistake, the other party knew of the mistake and made no effort to correct it. This makes the contract void.

undue influence

When one person applies improper mental or emotional pressure to force another to form a contract involuntarily.

duress

When one party uses threats or violence to force another to enter into a contract. This may be a form of blackmail. The victim or the victim’s spouse, children or parents may be targeted. The victim should have the contract voided as soon as possible.

For a person to give valid informed consent, three components must be present: disclosure, capacity and voluntariness.

* Disclosure requires a person to supply another person with the information necessary to make an autonomous decision. In a contract, the consent form must be written in lay language suited for the apprehension skills of, as well as the understanding of, all parties.

* Capacity pertains to the ability of a person to both understand the information provided and form a reasonable judgement based on the potential consequences of his/her decision.

* Voluntariness refers to a person’s right to freely exercise his/her decision making without being subjected to external pressure such as coercion, manipulation, or undue influence.

September 20, 2011

The Fed’s $16 Trillion Bailouts Under-reported –

“The audit of the Fed’s emergency lending programs was scarcely reported by mainstream media – albeit the results are undoubtedly newsworthy. It is the first audit of the Fed in United States history since its beginnings in 1913. The findings verify that over $16 trillion was allocated to corporations and banks internationally, purportedly for “financial assistance” during and after the 2008 fiscal crisis.”

“The GAO (Government Accounting Office) report (http://sanders.senate.gov/imo/media/doc/GAO%20Fed%20Investigation.pdf) said that the Fed issued “conflict of interest waivers to employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans.”

What international corporations and banks purportedly received $trillions from the Federal Reserve money laundering of U.S. tax dollars? The Crown (represents the “assumed” and therefore non-binding temporal authority of the Catholic Church Pope) and its Crown Corporations throughout Canada and the Vatican EU occupied Europe.

Former Canadian Bank of Canada (a Crown Corporation) Governor/Vatican FSB Chairman / Goldman Sachs debt creation specialist Mark Carney conspired with the Federal Reserve to steal and money launder $trillions out of the United States of America using Canadian banks that are Primary Dealers for the Federal Reserve Bank of New York. Mark Carney used his positions as both (at the same time) the Bank of Canada Governor and as the Vatican FSB Chairman (a major conflict-of-interest) to money launder (a felony) United States Federal Reserve bailout funds through Canadian banks to the Vatican Bank and its Crown Corporations (City of London Corporation / Bank of England). By doing so Mark Carney has created a debt crisis time bomb in Canada. A debt crisis bubble that was created by instructing Canada’s top banks – Royal Bank of Canada, Scotiabank, CIBC, BMO, and TD to launder embezzled U.S. tax dollars through their banks to the Crown – the Catholic Church owned Bank of England. All of the top 5 Canadians banks were also instructed by Mark Carney to load Canadians and Canadian businesses with unsecured and “unsolicited debt” using money illegally stolen and laundered through the Federal Reserve program known as the Term auction facility (TAF).

According to a Canadian Centre for Policy Alternatives (CCPA) report titled “The Big Banks’ Big Secret” (.pdf file download) Canadian banks processed $billions for the Federal Reserve (agents of the Crown/City of London Corporation/Bank of England) in 2008 – 2009. In the fall and spring of 2008 – 2009 the Royal Bank of Canada under Mark Carney’s Central Bank governor/Vatican FSB chairman leadership, received and processed for the Federal Reserve more than $43.6 billion in US tax dollars, Scotiabank received and transacted more than $27.8 billion, TD $27.5 billion, BMO $6.9 billion and CIBC $5.3 billion – money that was to be used only for U.S. banks and corporations but were secretly laundered by the Federal Reserve through Canadian banks under Mark Carney’s control. To enhance the liquidity of the commercial “paper” market during the 2008 financial crisis, the Federal Reserve also established the Commercial Paper Funding Facility (CPFF) in October 2008. CPFF used Canadian banks and Federal Reserve Bank of New York Primary Dealers BMO, RBC, and ScotiaBank.

Throughout the 2008-2010 financial crisis, Canadian Prime Minister Stephen Harper, Bank of Canada head Mark Carney and the Canadian banks themselves publicly stated that Canadian banks were very stable and that they needed no bailout. The CCPA report clearly suggests that they committed fraud – if in fact Canadian banks were also in financial trouble but falsely and publicly declared that they were not. Revenue overstatement is a fraud. The fact that they kept this from the US and Canadian public also means they willingly and willfully committed securities fraud – Canadian banks participated in the Federal Reserve Bank’s embezzlement and money laundering of U.S. tax dollar. Money laundering is the illegal activity of concealing the source of money obtained by illicit means.

Canadian banks committed securities fraud when they reported huge $billion profits for 2009 yet secretly received $billions in alleged short term financial aid loans from the Federal Reserve Bank through TAF. In fiscal 2009, RBC reported a profit of $3.858 billion, Scotiabank’s profit for the full year ended Oct. 31 was $3.55-billion, and TD earned $1-billion in profit in the fourth quarter of 2009 and at the same time all 3 received 10+/- times those profits from the US Federal Reserve – RBC received $43.6 billion, Scotiabank received more than $27.8 billion, and TD $27.5 billion. If they reported $billion profits, why are they getting or would even need financial aid loans from the United States Federal Reserve? Because they weren’t receiving financial aid loans they were money laundering $billions belonging to the U.S. people for the Federal Reserve. The CCPA report clearly states that in March 2009, Canadian banks received $114 billion in Federal Reserve loans. To put that into perspective, that is 7% of the Canadian economy in 2009 and was worth $3,400 for every man, woman and child in Canada. To hide the source of this money – money laundering – Mark Carney instructed the Canadian banks to issue unsecured and unsolicited loans, credit lines and mortgages to Canadians even if they were unemployed or didn’t have enough earnings or collateral to qualify.

Mark Carney acted as an agent of 2 foreign entities – the Crown and the Crown (Catholic Church Pope) imposed United States Federal Reserve. The Crown is doing exactly what they did in Greece. Their goal is to put Canada in the red. In 2001, just after Greece was admitted to the Vatican instituted EU (European Union), the Crown sent Goldman Sachs to help the Greece government secretly borrow billions. That deal was also hidden from public view as it was treated as a currency trade rather than a loan. Goldman Sachs’ fraud helped Athens meet the Vatican European Union’s deficit rules while continuing to spend beyond its means. We all know what happened later – Greece sovereign debt (interest debt to the Crown) crisis.

Just before the Vatican orchestrated U.S. financial crisis hit in 2008 Goldman Sachs (Board of Governors of the Federal Reserve System) had Canadian minority Prime Minister Stephen Harper appoint their debt creation specialist Mark Carney to head the Bank of Canada (a Crown Corporation). This appointment allowed the Federal Reserve to secretly money launder $trillions in U.S. Tax Dollars through Canadian banks that are regulated by the Bank of Canada Crown Corporation to the 1855 Crown established City of London Corporation to the Vatican Bank and Crown Corporations worldwide.

Mark Carney is no longer in Canada and is no longer governor of the Bank of Canada. He was rewarded, by the Crown (Catholic Church Pope Benedict XVI), the title and very lucrative position of Governor of the Bank of England for stealing (through bank fraud and money laundering) $trillions from the United States and Canada.

Canadian RBC bank primary money launderer of U.S. tax dollar to Vatican

The Canadian Royal Bank of Canada (RBC) is the primary money laundering bank for the U.S. Federal Reserve Bank and the Vatican Bank. RBC and other Canadian banks are Primary Dealers for the Federal Reserve Bank of New York. The same bank tax evader and former United States Secretary of the Treasury, Timothy Geithner headed as president. RBC has money laundered more money than any other Canadian bank.

The Federal Reserve Bank of New York website http://www.newyorkfed.org/markets/pridealers_current.html states – “Primary dealers serve as trading counterparties of the New York Fed in its implementation of monetary policy. This role includes the obligations to: (i) participate consistently in open market operations to carry out U.S. monetary policy (not Canadian monetary policy) pursuant to the direction of the Federal Open Market Committee (FOMC); and (ii) provide the New York Fed’s trading desk with market information (a.k.a espionage – the practice of spying or using spies to obtain information about the plans and activities especially of a foreign government – Canada – or a competing company – Bank of Canada, and insider trading – the buying or selling of a security by someone who has access to material, nonpublic information about the security. Insider trading is illegal when the material information is still nonpublic–trading while having special knowledge is unfair to other investors who don’t have access to such knowledge. Illegal insider trading therefore includes tipping others when you have any sort of nonpublic information.) and analysis helpful in the formulation and implementation of monetary policy.

Primary dealers (RBC, Scotiabank, BMO, TD, CIBC) are also required to participate in all auctions of U.S. government debt and to make reasonable markets for the New York Fed when it transacts (money laundering – the process of concealing the source of illegally obtained money – U.S. tax dollars through Federal Reserve Bank bailout schemes.) on behalf of its foreign official account-holders.”

Federal Reserve Primary dealers “serve, first and foremost, as trading counterparties of the Federal Reserve Bank of New York (The New York Fed) in its implementation of monetary policy.” Now that the Federla Reserve Bank has bankrupted the United States with its illegal counterfeit and interest bearing, Federal Reserve Note, they are now seeking to help the Crown (Catholic Church Pope) cause a debt crisis in financially strong Canada.

The Crown is determined to cause a debt crisis in Canada. It now appears that it is using Federal Reserve Bank of New York’s Canadian Primary Dealer, RBC Royal Bank, to implement a Canadian debt crisis. The first step to causing a debt crisis in Canada is to unilaterally raise interest rates. Since 2010, RBC has unilaterally and consistently raised its bank service fees and its credit card, credit line and loan interest rates even though the Bank of Canada hasn’t.

Canadians are already living on a very tight budget. Compounded with unsubstantiated rises in fuel cost, millions of Canadians are going to be forced into bankruptcy. All thanks to the illegal manipulation and control foreign state banks, Vatican Bank and the U.S. Federal Reserve Bank, has over conspiring Canadian bank RBC.

Both the Canadian Criminal Code and Security of Information Act declares that it a criminal offence for RBC or any Canadian bank, including the Bank of Canada, and their employees to disclose state secrets to a foreign entity. It is also an offence for any Canadian, corporation or entity to spy for a foreign state. That includes RBC, Scotiabank, TD, BMO, CIBC and the Crown Corporation Bank of Canada. The Canadian Security Intelligence Service Act defines “threats to the security of Canada” as:

(a) espionage or sabotage that is against Canada or is detrimental to the interests of Canada or activities directed toward or in support of such espionage or sabotage,

(b) foreign influenced activities within or relating to Canada that are detrimental to the interests of Canada and are clandestine or deceptive or involve a threat to any person,

The Criminal Code includes offences which prohibit bribery, frauds on the government and influence peddling, fraud or a breach of trust in connection with duties of office, municipal corruption, selling or purchasing office, influencing or negotiating appointments or dealing in offices, possession of property or proceeds obtained by crime, fraud, laundering proceeds of crime and secret commissions.

http://www.justice.gc.ca/eng/dept-min/pub/cfpoa-lcape/index.html

3.(1) Every person commits an offence who, in order to obtain or retain an advantage in the course of business, directly or indirectly gives, offers or agrees to give or offer a loan, reward, advantage or benefit of any kind to a foreign public official or to any person for the benefit of a foreign public official.

(a) as consideration for an act or omission by the official in connection with the performance of the official’s duties or functions; or

(b) to induce the official to use his or her position to influence any acts or decisions of the foreign state or public international organization for which the official performs duties or functions.

This offence is intended to apply to every person, whether Canadian or not, and within the full meaning of “person” as defined in section 2 of the Criminal Code, which states:

“every one”, “person”, “owner” and similar expressions include Her Majesty and public bodies, bodies corporate, societies, companies and inhabitants of counties, parishes, municipalities or other districts in relation to the acts and things that they are capable of doing and owning respectively.

Therefore, for the purposes of the offences under this Act, the potential accused are not limited to individuals, but may also include corporations; and under common law, corporations can be prosecuted for offences. The use of the Criminal Code definition of “person” means that the same principles of corporate criminal liability will apply under the new Act as apply to Criminal Code offences.

Security of Information Act

R.S.C., 1985, c. O-5

3. (1) For the purposes of this Act, a purpose is prejudicial to the safety or interests of the State if a person

(d) interferes with a service, facility, system or computer program, whether public or private, or its operation, in a manner that has significant adverse impact on the health, safety, security or economic or financial well-being of the people of Canada or the functioning of any government in Canada;

(j) adversely affects the stability of the Canadian economy, the financial system or any financial market in Canada without reasonable economic or financial justification;

(k) impairs or threatens the capability of a government in Canada, or of the Bank of Canada, to protect against, or respond to, economic or financial threats or instability;

(2) For the purposes of this Act, harm is caused to Canadian interests if a foreign entity or terrorist group does anything referred to in any of paragraphs (1)(a) to (n).

Short URL: https://presscore.ca/news/?p=10301

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

The Royal Bank of Canada’s role in the demise of the United States.

“Every bit of wealth is going to be counter traded out of the country and into the Royal Bank of Canada. Which is the collection basin for the American swapping activities” – George Hunt

http://www.youtube.com/watch?v=vKwEdiqcL2Q