2011 Congressional audit forfeited Federal Reserve franchise for violation of law.

Corruption, World news Monday, March 11th, 2013

A 2011 Congressional audit of the Federal Reserve found the Federal Reserve Bank guilty of violating US laws. The Sanders Report, a Government Accountability Office investigation record, revealed that the privately owned Federal Reserve secretly and “unlawfully” doled out $trillions in zero interest loans and concealed electronic funds transfers (a.k.a. money laundering) to itself and some of the largest financial institutions and corporations in the United States and throughout the world.

The investigative arm of Congress determined that the Federal Reserve acted illegally. In fact, according to the report, the Federal Reserve knew their financial transactions were illegal and provided conflict of interest waivers to its employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans.

During the financial crisis, at least 18 former and current directors from Federal Reserve Banks worked in banks and corporations that collectively received over $4 trillion in low-interest loans from the Federal Reserve – a.k.a Federal Reserve Bank of New York Timothy Geithner. Sanders gives you who and how much they illegally received in this US Senate report – http://www.sanders.senate.gov/imo/media/doc/061212DimonIsNotAlone.pdf

The US Congressional report provides evidence of major securities fraud in the embezzlement of as much as $16 trillion by the Federal Reserve and its bankers. Securities fraud and embezzlement are both felony criminal offenses. Any violation of law (criminal offense) committed by the Federal Reserve forfeits the Federal Reserve franchise – U.S. Code TITLE 12 CHAPTER 3 SUBCHAPTER IX § 341. Second states:

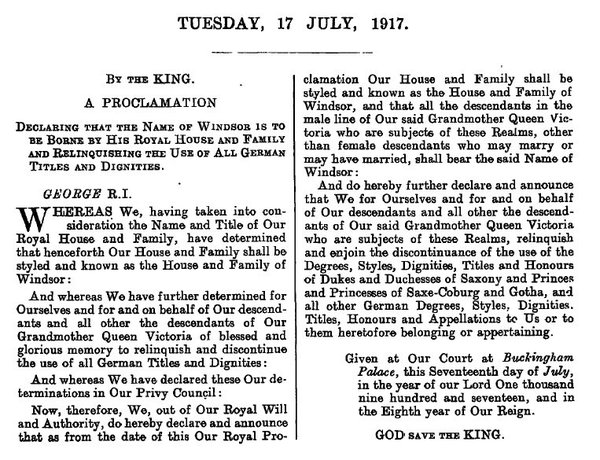

“A Federal reserve bank shall become a body corporate and as such, and in the name designated in such organization certificate, shall have power—

First. To adopt and use a corporate seal.

Second. To have succession after February 25, 1927, until dissolved by Act of Congress or until forfeiture of franchise for violation of law.”

This “how to get rid of the thieving Federal Reserve” provision is also clearly stated in the Federal Reserve Act, which can be found on the Federal Reserve Bank’s own website – http://www.federalreserve.gov/aboutthefed/section4.htm

Embezzlement is the act of dishonestly appropriating or secreting assets by one or more individuals to whom such assets have been entrusted. Embezzlement is performed in a manner that is premeditated, systematic and/or methodical, with the explicit intent to conceal the activities from other individuals, usually because it is being done without their knowledge or consent. U.S. Code TITLE 18 > PART I > CHAPTER 31 – EMBEZZLEMENT AND THEFT § 644. Banker receiving unauthorized deposit of public money

Whoever, not being an authorized depositary of public moneys, knowingly receives from any disbursing officer, or collector of internal revenue, or other agent of the United States, any public money on deposit, or by way of loan or accommodation, with or without interest, or otherwise than in payment of a debt against the United States, or uses, transfers, converts, appropriates, or applies any portion of the public money for any purpose not prescribed by law is guilty of embezzlement and shall be fined under this title or not more than the amount so embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined not more than $1,000 or imprisoned not more than one year, or both.

$16 trillion is 10 times more than what the U.S. Congress authorized and Bush ($700 billion) and Obama ( $787 billion) signed off on. The Federal Reserve was only authorized by Congress to disburse $1.487 trillion in federal tax dollars in bailouts and financial aid, not $16 trillion. The Federal Reserve embezzled (to appropriate fraudulently to one’s own use) another $14.5 trillion.

The Congressional report determined that the Fed secretly hide most of the embezzled money into their own banks. The rest the Fed unilaterally transfered trillions of dollars to foreign banks (Federal Reserve Bank of New York Primary Dealers) and corporations from Canada to the UK, from the UK to EU banks and corporations and as far away as South Korea. Foreign banks and corporations which the Federal Reserve bankers had a personal financial interest or stake in.

The list of institutions that received the most money from the Federal Reserve can be found on page 144 of this GAO government report – http://www.gao.gov/new.items/d11696.pdf

The Federal Reserve Bank of New York (Timothy Geithner) embezzled and money laundered US tax dollars to the following US Federal Reserve Banks and foreign “Central” banks. This list is a list of co-conspirators in the Federal Reserve Bank orchestrated US and EU financial Crisis. The money they stole and laundered caused the US and EU financial crisis. Their illegal activity created the Greece debt crisis (Goldman Sachs), the France debt crisis, the Spain debt crisis and the Italy debt crisis.

Citigroup: $2.5 trillion ($2,500,000,000,000) – ties with the CIA – In 2010 John M. Deutch, a former director of the Central Intelligence Agency, stepped down as a Citigroup director of 12 years. Citigroup/Citibank have been investigated for CIA Mexican and Afghanistan drug money laundering – Google “Citibank officer, Amy Elliot” In 2008, Citigroup reportedly lost $27.7 billion, and yet it awarded its employees $5.3 billion in bonuses. Report $27.7 billion in loses and get $2.5 trillion to cover your alleged loses.

Morgan Stanley: $2.04 trillion ($2,040,000,000,000) – earned $1.7 billion in all of 2008 yet handed out $4.475 billion in bonuses and received a whopping $2.04 trillion from the FED bank robbers.

Merrill Lynch: $1.949 trillion ($1,949,000,000,000) – In one year between July 2007 and July 2008, Merrill Lynch reportedly lost $19.2 billion yet handed out $3.6 billion in bonuses

Bank of America: $1.344 trillion ($1,344,000,000,000) – earned $4 billion in 2008 and paid out $3.3 billion in bonuses in 2008

Barclays PLC (United Kingdom): $868 billion ($868,000,000,000)

Bear Sterns: $853 billion ($853,000,000,000) – it received nearly $1 trillion even though it no longer existed as it was taken over by JP Morgan Chase in May of 2008 with the fraudulent help of Federal Reserve Bank of New York Timothy Geithner. Geithner gave a $30 billion loan to J.P. Morgan to buy Bear Sterns for $10 a share.

Goldman Sachs: $814 billion ($814,000,000,000) – earned $2.3 billion for the entire year 2008, reported it lost $2.1 billion on Dec 16, 2008 and then the very next day handed out $4.8 billion in bonuses. Goldman Sachs handed out more money in bonuses than what they earned all year.

Royal Bank of Scotland (UK): $541 billion ($541,000,000,000)

JP Morgan Chase: $391 billion ($391,000,000,000) – earned $5.6 billion in 2008 and paid out $8.69 billion in bonus money.

Deutsche Bank (Germany): $354 billion ($354,000,000,000)

UBS (Switzerland): $287 billion ($287,000,000,000)

Credit Suisse (Switzerland): $262 billion ($262,000,000,000)

Lehman Brothers: $183 billion ($183,000,000,000) – said it lost $3.9 billion in third-quarter of 2008 and handed out $2.5 billion in bonuses the same month – September 2008. Just days later, at 1:45AM on September 15, 2008, the firm filed for Chapter 11 bankruptcy protection. Banks that no longer exist got $1 trillion ($183 billion – Lehman Brothers + $853 billion – Bear Sterns) in US tax dollars from the heisters at the Federal Reserve.

Bank of Scotland (United Kingdom): $181 billion ($181,000,000,000)

BNP Paribas (France): $175 billion ($175,000,000,000) …

The Sanders report also reveals that the CEO of JP Morgan Chase served on the New York Fed’s board of directors at the same time that his bank received more than $390 billion in federal money from the Fed – a major conflict of interest. Moreover, JP Morgan Chase served as one of the clearing banks (money laundering banks) for Timothy Geithner’s Federal Reserve Bank of New York emergency loans programs (a.k.a – embezzlement schemes).

In another disturbing finding, the Government Accountability Office said that on Sept. 19, 2008, William Dudley, who is now the New York Fed president, was granted a waiver to let him keep investments in AIG and General Electric at the same time AIG and GE were given federal funds. At that time tax evader Timothy Geithner was president of the Federal Reserve Bank of New York. Timothy Geithner and Henry Paulson, Treasury Secretary and former CEO of Goldman Sachs, triggered the US financial crisis. One reason the Fed (Timothy Geithner) did not make Dudley sell his holdings, according to the audit, was that it would have exposed the Fed’s (Timothy Geithner) conflict of interest and major securities fraud in the embezzlement of $16 trillion.

The investigation also revealed that the Fed (Timothy Geithner) outsourced most of its embezzling to private contractors, many of which were rewarded with extremely low-interest and then-secret loans.

The Fed (Timothy Geithner) outsourced virtually all of the operations of their $16 trillion embezzlement scheme to private contractors like JP Morgan Chase, Morgan Stanley, and Wells Fargo. For their part the same firms also received trillions of dollars in Fed (Timothy Geithner) loans at near-zero interest rates. Morgan Stanley helped the Federal Reserve banker (Timothy Geithner) launder embezzled $trillions into AIG. Geithner and Henry Paulson used the bail out of AIG to money launder the US tax dollars.

A more detailed Government Accountability Office investigation into corruption charges, securities fraud, embezzlement, money-laundering and conflicts of interest at the Fed came out on Oct. 18. The Sanders Report on the GAO Audit on Major Conflicts of Interest at the Federal Reserve

Did you know that the $trillion the Federal Reserve embezzled (US Congress only authorized $1.487 trillion) could pay off the entire U.S. national debt. The U.S. government need only to seize the assets of the Federal Reserve banks (the big six U.S. banks collectively hold about $9.399 trillion in assets) and get back the $trillions that the Federal Reserve illegally embezzled and money laundered to their foreign banks and corporations.

The U.S. government can recover $trillions from the Federal Reserve and their banks through asset forfeiture. Asset forfeiture is confiscation, by the State, of assets which are either (a) the alleged proceeds of crime or (b) the alleged instrumentalities of crime, and more recently, alleged terrorism. Proceeds of crime means any economic advantage derived from or obtained directly or indirectly from a criminal offense or criminal offenses. Crimes committed by the Federal Reserve banks against the United States and its people include; conflict of interest, securities fraud, embezzlement, fraud, money laundering, hoarding, profiteering, larceny, racketeering . . .

In 1982, a criminal forfeiture provision was enacted as part of the Racketeering Influenced and Corrupt Organizations Act (“RICO”), 18 U.S.C. § 1961, which provided for the forfeiture of all property over which the RICO organization exercised an influence.

The Money Laundering Control Act of 1986 added new felony provisions at 18 U.S.C. § 1956 for the laundering of the proceeds of certain defined “specified unlawful activity,” as well as prohibiting structuring transactions under 31 U.S.C. § 5324 (with the intent to evade certain reporting requirements). The law also added civil and criminal forfeiture provisions at 18 U.S.C. §§ 981 and 982 for confiscating the property involved in money laundering.

According to the Legislative Guide to the United Nations Convention against Transnational Organized Crime and the Protocols Thereto, “Criminalizing the conduct from which substantial illicit profits are made does not adequately punish or deter organized criminal groups. Even if arrested and convicted, some of these offenders will be able to enjoy their illegal gains for their personal use and for maintaining the operations of their criminal enterprises. Despite some sanctions, the perception would still remain that crime pays. . . . Practical measures to keep offenders from profiting from their crimes are necessary. One of the most important ways to do this is to ensure that States have strong confiscation regimes”

Top 10 Banks in the United States

|

|

As of Mar. 31, 2010.

|

|

Source: Federal Reserve System, National Information Center.

|

According to United States Code, TITLE 12 CHAPTER 3 SUBCHAPTER IX § 341. Second. states that the U.S. Federal Reserve Banks are to be dissolved today by “forfeiture of franchise for violation of law.” Securities fraud and embezzlement by the Federal Reserve Bank is cause for immediate forfeiture and imprisonment of the Federal Reserve and its bankers.

List of banks involved in the $16 trillion + securities fraud and embezzlement

The Federal Reserve Bank of New York provides an up to date list of “Primary Dealers” obligated to implement the Federal Reserve fraud and embezzlement scheme. http://www.newyorkfed.org/markets/pridealers_current.html

“Primary dealers serve as trading counterparties of the New York Fed in its implementation of (Fed) monetary policy. This role includes the obligations to: (i) participate consistently in open market operations to carry out U.S. monetary policy pursuant to the direction of the Federal Open Market Committee (FOMC); and (ii) provide the New York Fed‘s trading desk with market information and analysis (non-public stock market information – aka insider trading) helpful in the formulation and implementation of monetary policy (so that the Fed can profit from this insider information). Primary dealers are also required to participate in all auctions of U.S. government debt (acquiring wealth generated from the transactions of the illicit funds – aka money laundering for the Fed) and to make reasonable markets for the New York Fed when it transacts on behalf of its foreign official account-holders. (the New York Fed is stating who they are working for – on behalf of its foreign official account- holders)”

List of Primary Dealers (Fed’s money laundering banks. Listed in alphabetical order only.)

Bank of Nova Scotia, New York Agency (the third largest bank in Canada. Opened New York Agency in 1907)

BMO Capital Markets Corp. (the fourth largest Canadian bank)

BNP Paribas Securities Corp. (Paris, France)

Barclays Capital Inc. (London, United Kingdom)

Cantor Fitzgerald & Co. (United States)

Citigroup Global Markets Inc. (FED, CIA drug money laundering bank, United States)

Credit Suisse Securities (USA) LLC (Zurich, Switzerland)

Daiwa Capital Markets America Inc. (Tokyo, Japan)

Deutsche Bank Securities Inc. (Frankfurt, Germany)

Goldman, Sachs & Co. (FED, United States)

HSBC Securities (USA) Inc. (founded in Hong Kong, headquarters London, United Kingdom)

Jefferies & Company, Inc. (United States)

J.P. Morgan Securities LLC (FED, United States)

Merrill Lynch, Pierce, Fenner & Smith Incorporated (United States)

Mizuho Securities USA Inc. (Tokyo, Japan)

Morgan Stanley & Co. LLC (FED, United States)

Nomura Securities International, Inc. (Tokyo, Japan)

RBC Capital Markets, LLC (a Canadian investment bank, part of Royal Bank of Canada)

RBS Securities Inc. (Royal Bank of Scotland Group)

SG Americas Securities, LLC (United States)

UBS Securities LLC. (Zürich & Basel, Switzerland. Rothschild controlled. The Rothschild family hold the popes purse strings from this bank – the keys of the Vatican is a predominate part of their logo.)

All of the above named banks (includes both U.S. and foreign banks) money laundered the over $16 trillion (U.S) that the Federal Reserve (Timothy Geithner) embezzled.

These banks money laundered the Fed (Timothy Geithner) embezzled U.S. Tax Dollars in three steps:

1) the illicit funds are introduced into the financial system by “placement”, – done overnight, after hours, in the form of zero interest and zero amortization loans and trades.

2) the “Primary Dealers” carried out complex financial transactions in order to camouflage the illicit funds (“layering”), and

3) they acquired wealth generated from the illegal transactions (loans, mortgages, stock market trading) of the illicit funds (“integration”).

All listed banks are controlled by the European Central Bank (Rothschild family) which controls it all for the Vatican, which is headed by the Nazi German Pope. All are working to enslave the World under a New World Order, aka Fourth Reich, aka Fourth unHoly Roman Empire.

Related article

How the Federal Reserve used Canadian banks to money launder $trillions in US tax dollars

1958 Prediction – America’s Destruction from the insiders.

Give me control of a nation’s money and I care not who makes it’s laws.

Short URL: https://presscore.ca/news/?p=3279

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

The Halifax International Security Forum was founded in 2009 as a propaganda program within the German Marshall Fund (founded June 5, 1972 by West German Chancellor Willy Brandt) by the Crown in Canada using Crown Corp ACOA & DND funds. The Halifax International Security Forum is a front that is used to recruit top US, UK and Canadian gov and military officials as double agents for Canada's WWI, WWII enemy and wage new Vatican Germany Cold War.

High Treason: s.46 (1) Every one commits high treason who, in Canada (c) assists an enemy at war with Canada, ..., whether or not a state of war exists". Every one who, in Canada assists Canada's enemies wage "piecemeal WWIII" Cold War by organizing, funding and participating in the Germany government politically and militarily benefitting / lead Halifax International Security Forum is committing high treason.

Please take a moment to sign a petition to

Please take a moment to sign a petition to

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

1917 Code of Canon Law, Canon 185 invalidates (voids) all papacies since October 26, 1958 due to the fact Cardinal Giuseppe Siri was elected Pope on the Third ballot on Oct 26 1958 but the new Pope Gregory XVII was illegally prevented from assuming the office. A Pope was elected on October 26, 1958. Thousands of people witnessed a new Pope being elected by seeing white smoke and millions were informed by Vatican radio broadcasts beginning at 6:00 PM Rome time on October 26, 1958. The papacy of Francis, Benedict, John Paul II, John Paul I, Paul VI, John XXIII and any and all of their respective doctrines, bulls, letter patents and the Second Vatican Council are all invalidated (having no force, binding power, or validity) by Canon 185 because the 1958 conclave of cardinals elected Cardinal Giuseppe Siri Pope on Oct 26 1958. Cardinal Giuseppe Siri accepted the papacy by taking the name Pope Gregory XVII but was illegally prevented from assuming his elected office.. According to Canon 185 Cardinal Angelo Giuseppe Roncalli illegally assumed the papacy 2 days later by fraud and grave fear, unjustly inflicted against Cardinal Giuseppe Siri who was lawfully elected Pope Gregory XVII. Because no Pope has been lawfully elected since October 26, 1958 the Holy See (la Santa Sede/Seat) remains vacant.

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online

Hold the Crown (alias for temporal authority of the reigning Pope), the Crown appointed Governor General of Canada David Lloyd Johnston, the Crown's Prime Minister (servant) Stephen Joseph Harper, the Crown's Minister of Justice and Attorney General Peter Gordon MacKay and the Crown's traitorous military RCMP force, accountable for their crimes of treason and high treason against Canada and acts preparatory thereto. The indictment charges that they, on and thereafter the 22nd day of October in the year 2014, at Parliament in the City of Ottawa in the Region of Ontario did, use force and violence, via the staged false flag Exercise Determined Dragon 14, for the purpose of overthrowing and besieging the government of Canada contrary to Section 46 of the Criminal Code. In a society governed by the rule of law, the government and its officials and agents are subject to and held accountable under the law. Sign the online  Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

Two of the most obvious signs of a dictatorship in Canada is traitorous Stephen Harper flying around in a "military aircraft" and using Canadian Special Forces "military" personnel from JTF2 and personnel from the Crown's traitorous martial law "military" RCMP force as his personal bodyguards.

The U.S. government bailouts of the Federal Reserve banks are nothing more than an elaborate money laundering scheme. They are criminal acts perpetrated by the presidents of the United States against its investors – the US people. Both Bush and Obama declared that it was in the best interest of the people to invest $trillions to save a handful of banks owned by the Federal Reserve. Their investment of tax dollars was guaranteed by both Bush and Obama. Each and every bank was given more money (tax dollars) than was actually needed. Instead of helping to fix the US financial crisis the governments of Bush and Obama added to the crisis by literally giving away money that in most cases were 4 to 6, even 10 times the entire yearly earnings reported by the banks.

According to a study on executive compensation released by New York State Attorney General Andrew Cuomo:

• Goldman Sachs, which earned $2.3 billion for the entire year 2008 and received approximately 4 times their net earnings or $10 billion in TARP funding, paid out $4.8 billion in bonuses in 2008 – more than double their net 2008 income.

• Morgan Stanley, which earned $1.7 billion in 2008 and received approximately 6 times their net earnings or $10 billion in bailout funds, handed out $4.475 billion in bonuses, nearly three times their net income.

• JPMorgan Chase, which earned $5.6 billion in 2008 and received approximately 4 times their net 2008 earnings or $25 billion from the government, paid out $8.69 billion in bonus money.

• Citigroup and Merrill Lynch lost a combined $54 billion in 2008. They received a total of $55 billion in bailouts which they used to wipe out their entire $54 billion debt from their book then put themselves back in debt by handing out $9 billion in combined bonuses. ($5.33 billion for Citigroup; $3.6 billion for Merrill Lynch, which was subsequently acquired by Bank of America.)

• Bank of America earned $4 billion in 2008 and paid out $3.3 billion in bonuses in 2008 immediately after the bank received $45 billion in TARP funds. They were given over 10 times their net earning for 2008. Bank of America used the bailout money to buy up banks including Merrill Lynch which they paid $50 billion for. Bank of America actually money laundered federal aid money – used to purchase high-value items (other banks) to change the form of the money – took tax payers’ dollars and bought other banks.

• AIG was given more than $173 billion in Bush / Obama bailout scheme money. The Wall Street Journal reported that about $50 billion of more than $173 billion that the U.S. government has poured into American International Group Inc since last fall has been paid to at least two dozen U.S. and foreign financial institutions. The newspaper reported that some of the banks paid by AIG since the insurer started getting taxpayer funds were: Goldman Sachs Group Inc, Deutsche Bank AG, Merrill Lynch, Societe Generale, Calyon, Barclays Plc, Rabobank, Danske, HSBC, Royal Bank of Scotland, Banco Santander, Morgan Stanley, Wachovia, Bank of America, and Lloyds Banking Group. American International Group Inc. lost $62 billion in just 92 days or so they declared in order to get $173 billion from the US people. AIG was used by Bush and Obama to money launder more US tax dollars to banks that had already received $billions. They went through AIG to intentionally hide money transactions that were obtained illegally by faked and or falsified bank quarterly financial reports.

Both Bush and Obama actions are criminal, idiotic to say the least. Its a classic case of dumb and dumber. Both have got to be either the dumbest people on the planet when it comes to leadership and handling a crisis or the craftiest criminal masterminds in the world. How they handled the US economic crisis proves this.

Both Bush and Obama were given an amount that would be needed to fix the problem but they both paid 4 to 6 times the asking price. If you were shopping to buy a good used vehicle and you found one and the asking price was $10,000 would you give $40 – 60,000 to the seller? Of course you wouldn’t. But that is exactly what both Bush and Obama have done. They’ve given away 4 to 6 times the asking price for a lemon. They both illegally took large sums of money from the American people (tax dollars) and poured it into allegedly failing Federal Reserve owned or controlled banks which they (the reported failing banks) used the legitimate banking system to launder the Bush / Obama money to other banks. The US tax dollars were suppose to be used to buy up all the failing banks’ worthless bad debt (no evidence exists or has ever been presented to actually verify that the money was ever actually used to buy up any bad debt). Instead the money was actually used illegally to buy other banks and write big fat bonus checks to each and every money laundering conspirator – including Bush and Obama.

No sooner had Obama signed his $787 billion bonus plan check to the Federal Reserve bankers in February 2009 than the first major disclosure of corruption were reported by federal investigators in April 2009. The LA Times reported that federal investigators had opened at least 20 criminal probes into possible securities fraud, tax violations, insider trading and other crimes. http://articles.latimes.com/2009/apr/21/nation/na-tarp-fraud21

The disclosures reinforce fears that the hastily designed and rapidly changing bailout program run by the Treasury Department and Federal Reserve is going to carry a heavy price.

What started out as a $787 billion effort only to buy toxic securities has morphed into at least 12 separate programs that cover up over $16 trillion in direct financial transfers, zero interest loans, loan guarantees and bank bonuses by and to the Federal Reserve bankers.

On the Federal Reserve Bank of New York website under “Administration of Relationships with Primary Dealers’ it defines the role of the “Primary Dealers”. “The primary dealers serve, first and foremost, as trading counterparties of the Federal Reserve Bank of New York (The New York Fed) in its implementation of monetary policy.

A counterparty is a legal and financial term. It means a party to a contract. That means all of the listed “Primary Dealers” are under contract with the Federal Reserve Bank of New York. The contract requires all “Primary Dealers” to serve, first and foremost, as trading agents of the Fed. The Fed is their boss. That means foreign banks, including listed Canadian banks are required to implement the polices of the United States Central bank – the Fed. Canadian banks listed are aiding and abetting a foreign government. Any Canadian or corporation who spies for a foreign power, or reveals state secrets to a foreign power in peacetime is committing the crime of “treason”. Canadian banks listed as “Primary Dealers” for the United States Federal Reserve Bank of New York are spying for the United States. They are disclosing, without lawful authority, financial records and statements to agents (Federal Reserve Bank of New York) of a foreign state (the United States). They know or should know that the material being transferred to the Federal Reserve Bank of New York may be used to impair Canada’s economic independence and prosperity.

Prime Minister Stephen Harper stated last year that Europe must sort out its own economic mess — and flatly stated that Canada will not provide any funds to bail out the continent. That was a flat out lie. Harper is lying to the Canadian people. Canada has secretly transferred Canadian funds to the European bailout fund. Bank of Canada governor Mark Carney was appointed head of the Vatican created Financial Stability Board (FSB) – reported by CBC News on November 4, 2011. http://www.cbc.ca/news/canada/story/2011/11/04/mark-carney-financial-stability-board.html

As leader of the FSB, Carney is endorsing U.S. controlled International Monetary Fund (IMF) to redistribute global liquidity (redistribution of the Global wealth – aka communism). Carney is allowed to remain head of Canada’s central bank while also being head of the FSB. A major conflict of interest now exists because the primary role of the Bank of Canada is to “promote the economic and financial well-being of Canada.” Today the Bank of Canada mandate has been severely compromised as its leader is now head of the FSB – an organization that was set up to promote the economic and financial well-being of the Vatican. The role of the FSB is to create a World central bank with the Pope holding the money for the entire world.

On October 25, 2011 the Vatican made public its intent. “A “global public authority” should be established to impose fresh curbs on financial institutions, including a tax on financial instruments”. The Vatican wants a financial transactions tax (FTT) to be imposed on all financial transactions – World wide. The new tax will be imposed on the customers of the institutions rather than the owners of the institutions. Where will this tax revenue go to? To the pedophilic Vatican of course.

The Vatican urged the G20 and the UN to create “a kind of central world bank” to discipline markets and, later on, a world government or “public authority with universal jurisdiction”.

The The National Post (Canadian publication) quoted the Vatican as saying,

“Of course, this transformation will be made at the cost of a gradual, balanced transfer of a part of each nation’s powers to a world authority and to regional authorities, but this is necessary at a time when the dynamism of human society and the economic and the progress of technology are transcending borders, which are in fact already very eroded in a globalised world.”

This central World bank has already been created – The Financial Stability Board or FSB ~ a public authority with universal jurisdiction – or so the pedophiles at that Vatican claim. The Vatican report was released in Canada because the head of the Bank of Canada is also now the head of the Vatican’s FSB.

http://www.news.va/en/news/full-text-note-on-financial-reform-from-the-pontif

The second report on the Government Accountability Office investigation into corruption charges, securities fraud, embezzlement, money-laundering and conflicts of interest at the Federal Reserve has been made public.

The Sanders Report on the GAO Audit on Major Conflicts of Interest at the Federal Reserve

The U.S. Federal Reserve Banks can be dissolved today by “forfeiture of franchise for violation of law.” The Sanders Report presents concrete indictable evidence that the Federal Reserve willingly and knowingly violated the law and as per United States Code, TITLE 12 CHAPTER 3 SUBCHAPTER IX § 341. the Federal Reserve is hereby forfeited.

“I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a monied aristocracy that has set the government at defiance. The issuing power (of money) should be taken away from the banks and restored to the people to whom it properly belongs.” — Thomas Jefferson, U.S. President.

“The regional Federal Reserve banks are not government agencies. …but are independent, privately owned and locally controlled corporations.” — Lewis vs. United States, 680 F. 2d 1239 9th Circuit 1982

“It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” — Henry Ford

The “List of Primary Dealers” listed in this article comes directly from the Federal Reserve Bank of New York website. http://www.newyorkfed.org/markets/pridealers_current.html

The list is listed in the exact same order as listed by the Fed New York Bank. I just added the nationality to the listed banks.

The fact that the Federal Reserve Bank of New York states that all named “Primary Dealers” are obligated and are required to participate means the named banks are now controlled by the Federal Reserve Bank of New York. The Federal Reserve Bank of New York makes this fact perfectly clear with their policy statement – “The primary dealers “serve”, first and foremost, as trading counterparties of the Federal Reserve Bank of New York (The New York Fed) in its implementation of monetary policy.” http://www.newyorkfed.org/markets/pridealers_policies.html

“This policy sets the standards for primary dealers (Standards). Each primary dealer must meet the Standards, initially and on an on-going basis. ”

The current United States Secretary of the Treasury, Timothy Geithner, was the 9th President of the Federal Reserve Bank of New York. November 17, 2003 – January 26, 2009. Geithner, as president of the New York Fed, was the syndicate’s boss. He created the primary dealers group to money launder the money he and the United States Secretary of the Treasury predecessor and Goldman Sachs CEO Henry Paulson stole from the American people.